- •Contents

- •Investment summary

- •Reporting schedule

- •Earnings revisions

- •Reporting trends: 2H18E vs 2H17

- •Reporting trends 2H18E vs 1H18

- •Results previews

- •Commodity price and exchange rate forecasts

- •Peer comp charts

- •African Rainbow Minerals

- •Alrosa

- •Anglo American

- •Assore

- •Exxaro

- •Glencore

- •Kumba Iron ore

- •NorNickel

- •Rio Tinto

- •Rusal

- •Vale

- •Gold Fields

- •Harmony

- •Polymetal

- •Anglo American Platinum

- •Lonmin

- •Northam

- •Royal Bafokeng Platinum

- •Acron

- •PhosAgro

- •Evraz

- •Disclosures appendix

vk.com/id446425943

Reporting trends 2H18E vs 1H18

Renaissance Capital

6 February 2019

Metals & Mining

Figure 9: 2H18E vs 1H18, $mn

|

Underlying earnings, $mn |

Dividends, $mn |

Cu. eq production, kt |

|

Capex, $mn |

|

Net debt, $mn |

|||||||||

|

2H18E |

1H18 |

% ch |

2H18E |

1H18 |

% ch |

2H18E |

1H18 |

% ch |

|

2H18E |

1H18 |

% ch |

2H18E |

1H18 |

% ch |

Diversified miners |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

African Rainbow Minerals |

193 |

232 |

-17% |

94 |

116 |

-19% |

142 |

149 |

-4% |

|

117 |

122 |

-4% |

-121 |

-81 |

-49% |

Alrosa |

657 |

969 |

-32% |

1,247 |

639 |

95% |

676 |

518 |

30% |

|

299 |

184 |

63% |

727 |

101 |

618% |

Anglo American |

1,754 |

1,565 |

12% |

702 |

622 |

13% |

1,391 |

1,358 |

2% |

|

1,048 |

1,220 |

-14% |

3,090 |

3,987 |

-23% |

Assore |

197 |

218 |

-10% |

138 |

136 |

1% |

112 |

117 |

-5% |

|

10 |

16 |

-40% |

-705 |

-639 |

-10% |

BHP |

3,926 |

4,964 |

-21% |

8,113 |

3,354 |

142% |

2,940 |

3,275 |

-10% |

|

3,972 |

2,396 |

66% |

10,316 |

10,934 |

-6% |

Exxaro |

318 |

249 |

28% |

106 |

108 |

-2% |

249 |

238 |

4% |

|

333 |

204 |

63% |

288 |

369 |

-22% |

Fortescue |

544 |

198 |

175% |

308 |

288 |

7% |

814 |

838 |

-3% |

|

270 |

477 |

-43% |

2,921 |

3,112 |

-6% |

Glencore |

3,024 |

3,293 |

-8% |

4,148 |

0 |

- |

2,628 |

2,402 |

9% |

|

5,624 |

2,165 |

160% |

36,203 |

31,894 |

14% |

Kumba Iron Ore |

472 |

242 |

95% |

520 |

380 |

37% |

182 |

174 |

4% |

|

167 |

116 |

44% |

-954 |

-948 |

-1% |

Norilsk Nickel |

1,728 |

1,675 |

3% |

1,857 |

1,562 |

19% |

767 |

740 |

4% |

|

1,114 |

536 |

108% |

7,466 |

5,830 |

28% |

Rio Tinto |

4,263 |

4,416 |

-3% |

2,502 |

2,211 |

13% |

3,090 |

2,966 |

4% |

|

3,566 |

2,584 |

38% |

1,151 |

5,229 |

-78% |

Rusal |

965 |

952 |

1% |

396 |

0 |

- |

741 |

679 |

9% |

|

353 |

417 |

-15% |

7,093 |

7,875 |

-10% |

South32 |

611 |

783 |

-22% |

485 |

317 |

53% |

598 |

626 |

-4% |

|

1,741 |

231 |

654% |

-1,101 |

-2,041 |

46% |

Vale |

4,264 |

3,881 |

10% |

0 |

2,054 |

-100% |

2,824 |

2,472 |

14% |

|

1,886 |

499 |

278% |

8,778 |

11,537 |

-24% |

Total – diversifieds |

22,915 |

23,638 |

-3% |

20,617 |

11,789 |

75% |

17,153 |

16,552 |

4% |

|

20,501 |

11,167 |

84% |

75,152 |

77,159 |

-3% |

Platinum miners |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Anglo American Platinum |

342 |

273 |

25% |

103 |

82 |

26% |

303 |

243 |

25% |

|

254 |

225 |

13% |

-57 |

-39 |

-48% |

Impala |

75 |

-88 |

186% |

0 |

0 |

- |

201 |

164 |

22% |

|

165 |

241 |

-31% |

246 |

540 |

-54% |

Northam |

-1 |

-34 |

97% |

0 |

0 |

- |

75 |

51 |

47% |

|

65 |

100 |

-35% |

884 |

997 |

-11% |

Royal Bafokeng Platinum |

4 |

-1 |

506% |

0 |

0 |

- |

26 |

25 |

3% |

|

126 |

112 |

12% |

71 |

59 |

20% |

Total – platinum |

420 |

151 |

179% |

103 |

82 |

26% |

605 |

484 |

25% |

|

610 |

677 |

-10% |

1,144 |

1,558 |

-27% |

Gold miners |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

AngloGold Ashanti |

140 |

85 |

65% |

31 |

0 |

- |

351 |

323 |

8% |

|

436 |

335 |

30% |

1,759 |

1,783 |

-1% |

Gold Fields |

73 |

43 |

69% |

22 |

13 |

67% |

190 |

197 |

-4% |

|

402 |

397 |

1% |

1,523 |

1,393 |

9% |

Harmony |

91 |

-18 |

591% |

12 |

0 |

- |

143 |

122 |

17% |

|

180 |

163 |

10% |

317 |

399 |

-21% |

Polymetal |

289 |

155 |

86% |

150 |

77 |

95% |

191 |

128 |

50% |

|

180 |

185 |

-3% |

1,418 |

1,652 |

-14% |

Polyus |

634 |

680 |

-7% |

262 |

301 |

-13% |

262 |

220 |

19% |

|

414 |

401 |

3% |

3,275 |

3,208 |

2% |

Sibanye |

41 |

-42 |

198% |

0 |

0 |

- |

278 |

276 |

1% |

|

280 |

248 |

13% |

1,424 |

1,937 |

-26% |

Total – gold |

1,268 |

902 |

40% |

478 |

391 |

22% |

1,415 |

1,266 |

12% |

|

1,892 |

1,729 |

9% |

9,716 |

10,372 |

-6% |

Total precious metals |

1,688 |

1,053 |

60% |

580 |

473 |

23% |

2,020 |

1,750 |

15% |

|

2,502 |

2,407 |

4% |

10,860 |

11,930 |

-9% |

Steel companies |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ArcelorMittal |

-45 |

2 |

-2934% |

0 |

0 |

- |

170 |

178 |

-5% |

|

30 |

45 |

-33% |

161 |

342 |

-53% |

Evraz |

881 |

917 |

-4% |

705 |

733 |

-4% |

766 |

753 |

2% |

|

332 |

323 |

3% |

3,645 |

3,872 |

-6% |

MMK |

650 |

709 |

-8% |

665 |

547 |

22% |

525 |

525 |

0% |

|

404 |

424 |

-5% |

-302 |

-229 |

-32% |

NLMK |

1,148 |

1,150 |

0% |

1,133 |

1,097 |

3% |

809 |

799 |

1% |

|

370 |

314 |

18% |

1,015 |

1,032 |

-2% |

Total – steel |

2,635 |

2,777 |

-5% |

2,504 |

2,377 |

5% |

2,269 |

2,254 |

1% |

|

1,136 |

1,107 |

3% |

4,519 |

5,017 |

-10% |

Fertiliser companies |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Acron |

208 |

101 |

106% |

24 |

195 |

-88% |

145 |

145 |

0% |

|

126 |

104 |

21% |

1,129 |

1,196 |

-6% |

PhosAgro |

363 |

302 |

20% |

76 |

28 |

171% |

253 |

268 |

-6% |

|

280 |

279 |

0% |

1,817 |

2,068 |

-12% |

Total – fertilisers |

571 |

403 |

42% |

100 |

223 |

-55% |

397 |

413 |

-4% |

|

406 |

383 |

6% |

2,946 |

3,264 |

-10% |

Total metals & mining |

27,809 |

27,871 |

0% |

23,801 |

14,861 |

73% |

21,840 |

20,969 |

4% |

|

24,544 |

15,064 |

63% |

93,476 |

97,370 |

-4% |

Source: Company data, Renaissance Capital estimates

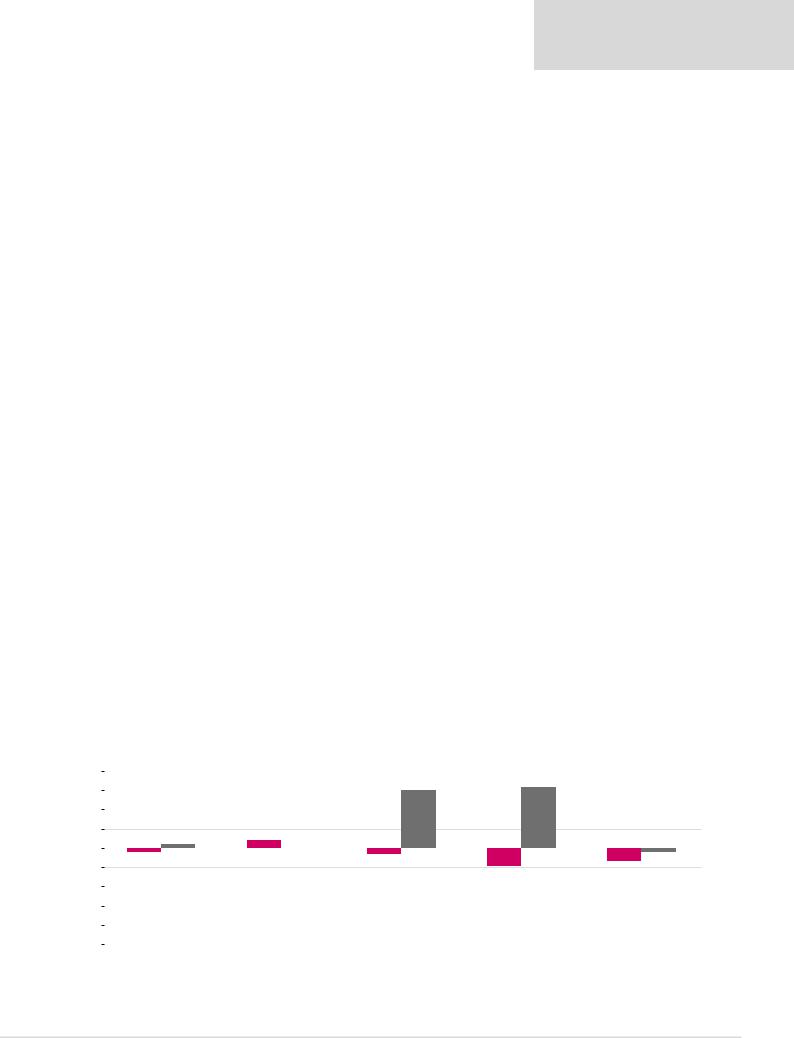

Figure 10: 2H CY18 forecasts vs 1H CY18 and the previous year |

|

|

|

|

|

|

|||||

80% |

|

|

|

% change 1H18 over 2H17 |

|

% change 2H18E over 1H18 |

|

|

|||

|

|

|

|

|

|

||||||

|

|

|

|

|

|

||||||

|

|

|

|

|

60% |

63% |

|

|

|||

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|||

60% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

40% |

|

|

|

|

|

|

|

|

|

|

|

|

8% |

|

|

|

|

|

|

|

|

||

20% |

4% |

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

||

0% |

|

|

|

|

|

|

|

|

|

|

|

-4% |

0% |

-6% |

|

|

|

|

-4% |

||||

-20% |

|

|

|

|

|||||||

|

|

|

|

|

|

-19% |

-13% |

||||

|

|

|

|

|

|

|

|

|

|||

-40% |

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

||

-60% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

-80% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

-100% |

|

|

|

|

|

|

|

|

|

|

|

Cu eq production |

Underlying earnings |

Dividends |

Capex |

Net debt |

|||||||

|

|||||||||||

Source: Company data, Renaissance Capital estimates

10