- •Contents

- •Investment summary

- •Reporting schedule

- •Earnings revisions

- •Reporting trends: 2H18E vs 2H17

- •Reporting trends 2H18E vs 1H18

- •Results previews

- •Commodity price and exchange rate forecasts

- •Peer comp charts

- •African Rainbow Minerals

- •Alrosa

- •Anglo American

- •Assore

- •Exxaro

- •Glencore

- •Kumba Iron ore

- •NorNickel

- •Rio Tinto

- •Rusal

- •Vale

- •Gold Fields

- •Harmony

- •Polymetal

- •Anglo American Platinum

- •Lonmin

- •Northam

- •Royal Bafokeng Platinum

- •Acron

- •PhosAgro

- •Evraz

- •Disclosures appendix

vk.com/id446425943

Vale – HOLD

Renaissance Capital

6 February 2019

Metals & Mining

Figure 90: Vale, $mn (unless otherwise noted)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Vale |

|

|

|

|

VALE.N |

|

|

|

|

|

Target price, $: |

|

|

13.6 |

||

Market capitalisation, $mn: |

|

|

|

|

64,869 |

|

|

|

|

|

Last price, $: |

|

|

12.6 |

||

Enterprise value, $mn: |

|

|

|

|

85,158 |

|

|

|

|

|

Potential 12-month return: |

|

8.2% |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dec-YE |

|

|

|

2016 |

2017 |

2018E |

2019E |

2020E |

Dec-YE |

2016 |

2017 |

|

2018E |

2019E |

2020E |

|

Income statement |

|

|

|

|

|

|

|

|

|

Balance sheet |

|

|

|

|

|

|

Revenue |

|

|

|

29,334 |

35,713 |

37,397 |

39,332 |

37,786 |

|

Net operating assets |

66,066 |

62,915 |

|

53,125 |

55,785 |

57,592 |

Adjusted EBITDA |

|

|

|

12,181 |

15,337 |

17,312 |

18,515 |

15,841 |

|

Investments |

18 |

18 |

|

6 |

6 |

7 |

Adjusted EBIT |

|

|

|

8,267 |

10,873 |

13,750 |

14,857 |

12,055 |

|

Equity |

39,042 |

43,458 |

|

43,493 |

50,453 |

55,447 |

Net interest |

|

|

|

1,966 |

-3,019 |

-6,069 |

-2,066 |

-1,900 |

|

Minority interest |

1,982 |

1,314 |

|

860 |

868 |

876 |

Taxation |

|

|

|

-2,781 |

-830 |

-1,525 |

-2,589 |

-1,862 |

|

Net debt (target: $10bn) |

25,060 |

18,161 |

|

8,778 |

4,470 |

1,276 |

Minority interest in profit |

|

|

|

6 |

-14 |

-1 |

-40 |

-40 |

|

|

|

|

|

|

|

|

Net profit for the year |

|

|

|

5,277 |

6,935 |

5,821 |

6,960 |

4,994 |

|

Balance sheet ratios |

|

|

|

|

|

|

Underlying earnings |

|

|

|

4,968 |

7,188 |

8,145 |

9,515 |

7,549 |

|

Gearing * |

30.8% |

22.0% |

|

10.7% |

5.4% |

1.5% |

Underlying EPS, $ |

|

|

|

0.96 |

1.39 |

1.57 |

1.84 |

1.46 |

|

Net debt to EBITDA |

2.1x |

1.2x |

|

0.5x |

0.2x |

0.1x |

|

|

|

|

RoCE |

13.1% |

16.4% |

|

22.4% |

25.7% |

20.1% |

||||||

Thomson Reuters consensus EPS, $ |

|

|

|

|

1.32 |

1.81 |

1.58 |

|

RoIC (after tax) |

12.6% |

19.8% |

|

15.7% |

17.4% |

13.7% |

|

DPS declared, $ |

|

|

|

0.27 |

0.28 |

0.40 |

0.00 |

0.00 |

|

RoE |

13.7% |

17.4% |

|

18.7% |

20.3% |

14.3% |

Adjusted EBIT |

|

|

|

|

|

|

|

|

|

Cash flow statement |

|

|

|

|

|

|

Ferrous Minerals |

|

|

|

8,747 |

11,497 |

13,385 |

14,724 |

10,924 |

|

Operating cash flow |

10,030 |

16,819 |

|

12,946 |

14,237 |

12,447 |

EBIT margin |

|

|

|

43% |

46% |

47% |

48% |

40% |

|

Capex less disposals |

-5,480 |

-4,154 |

|

-2,385 |

-5,792 |

-5,241 |

Coal |

|

|

|

-244 |

-25 |

21 |

59 |

80 |

|

Other cash flows |

-987 |

-1,825 |

|

3,001 |

-2,555 |

-2,555 |

EBIT margin |

|

|

|

-29% |

-2% |

1% |

3% |

4% |

|

FCF |

3,563 |

10,840 |

|

13,562 |

5,890 |

4,652 |

Base metals |

|

|

|

36 |

501 |

991 |

535 |

1,495 |

|

Equity shareholders' cash |

702 |

8,574 |

|

12,538 |

4,308 |

3,194 |

EBIT margin |

|

|

|

1% |

7% |

15% |

8% |

19% |

|

Dividends and share buy-backs |

-500 |

-1,675 |

|

-3,155 |

0 |

0 |

Fertiliser nutrients |

|

|

|

-138 |

-885 |

-109 |

0 |

0 |

|

Excess cash |

202 |

6,899 |

|

9,383 |

4,308 |

3,194 |

EBIT margin |

|

|

|

-7% |

-51% |

-122% |

n/a |

n/a |

Cash flow ratios |

|

|

|

|

|

|

|

Others and logistics |

|

|

|

-134 |

-215 |

-538 |

-461 |

-444 |

|

|

|

|

|

|

|

|

EBIT margin |

|

|

|

-84% |

-54% |

-169% |

-120% |

-111% |

|

Working capital days |

0 |

7 |

|

11 |

8 |

7 |

Adjusted EBIT - Group production |

|

|

8,267 |

10,873 |

13,750 |

14,857 |

12,055 |

|

Capex/EBITDA |

45.0% |

27.1% |

|

13.8% |

31.3% |

33.1% |

|

Income statement ratios |

|

|

|

|

|

|

|

|

|

FCF yield |

6.6% |

15.4% |

|

16.9% |

8.4% |

6.9% |

|

|

|

|

|

|

|

|

|

Equity shareholders' yield |

2.6% |

16.9% |

|

17.8% |

6.6% |

4.9% |

|

EBITDA margin |

|

|

|

41.5% |

42.9% |

46.3% |

47.1% |

41.9% |

|

Cash conversion |

0.1x |

1.2x |

|

1.5x |

0.5x |

0.4x |

EBIT margin |

|

|

|

28.2% |

30.4% |

36.8% |

37.8% |

31.9% |

|

Valuation |

|

|

|

|

|

|

EPS growth |

|

|

|

393% |

44% |

13% |

17% |

-21% |

|

|

|

|

|

$mn |

$ |

|

Dividend payout ratio |

|

|

|

29% |

20% |

25% |

0% |

0% |

|

SoTP valuation and calculation of target price |

|

|

|

|||

Input assumptions |

|

|

|

|

|

|

|

|

|

Ferrous minerals |

|

|

|

|

86,145 |

16.7 |

|

|

|

|

|

|

|

|

|

Coal |

|

|

|

|

1,051 |

0.2 |

|

Iron ore fines (62%Fe,CIF China), $/t |

|

|

58 |

71 |

66 |

75 |

67 |

|

Base metals |

|

|

|

|

7,729 |

1.5 |

|

Brazil to China freight charge, $/t |

|

|

|

9 |

15 |

18 |

19 |

18 |

|

Fertiliser nutrients |

|

|

|

|

1,540 |

0.3 |

Nickel, $/t |

|

|

|

9,599 |

10,404 |

13,130 |

11,530 |

14,285 |

|

Others and logistics |

|

|

|

|

-5,674 |

-1.1 |

Copper, $/t |

|

|

|

4,867 |

6,170 |

6,532 |

6,000 |

6,367 |

|

Total enterprise value |

|

|

|

|

90,791 |

17.6 |

Thermal coal, $/t |

|

|

|

64 |

85 |

98 |

93 |

86 |

|

Net debt as at latest year end |

|

|

|

|

-18,161 |

-3.5 |

Hard coking coal, $/t |

|

|

|

144 |

188 |

206 |

178 |

161 |

|

Cash used in share buy-backs |

|

|

|

|

-497 |

-0.1 |

$/BRL |

|

|

|

3.49 |

3.19 |

3.65 |

3.78 |

3.50 |

|

Other investments |

|

|

|

|

18 |

0.0 |

|

|

|

|

|

|

|

|

|

|

Minority interest (DCF value) |

|

|

|

|

-2,128 |

-0.4 |

Required breakeven price |

|

|

|

|

|

|

|

|

|

Equity value as at 4/2/2019 |

|

|

|

|

70,022 |

13.6 |

Iron ore, $/t |

|

|

|

27 |

32 |

25 |

28 |

33 |

|

Rounded to |

|

|

|

|

|

13.6 |

Metallurgical coal, $/t |

|

|

|

192 |

152 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

183 |

167 |

149 |

|

Share price on 1/2/2019 |

|

|

|

|

|

12.6 |

|||

Nickel, $/t |

|

|

|

8,160 |

9,137 |

8,998 |

9,214 |

9,216 |

|

Expected share price return |

|

|

|

|

|

8.2% |

Copper, $/t |

|

|

|

2,893 |

2,341 |

3,379 |

3,373 |

3,012 |

|

Plus: expected dividend yield |

|

|

|

|

|

0.0% |

Sales volumes |

|

|

|

|

|

|

|

|

|

Total implied one-year return |

|

|

|

|

|

8.2% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Iron ore, mnt |

|

|

|

293 |

289 |

317 |

311 |

305 |

|

Share price range, $: |

|

|

|

|

|

|

Iron pellets, mnt |

|

|

|

48 |

52 |

55 |

49 |

55 |

|

12-month high on 3/10/2018 |

16.13 |

12-month low on 28/1/2019 |

11.08 |

|||

Nickel, kt |

|

|

|

311 |

294 |

236 |

248 |

264 |

|

Price move since high |

-22.1% |

Price move since low |

|

13.4% |

||

Copper, kt |

|

|

|

430 |

424 |

378 |

417 |

427 |

|

|

|

|

|

|

|

|

Attributable Cu eq volumes, kt |

|

|

|

5,510 |

5,489 |

5,296 |

5,290 |

5,457 |

|

Calculation of WACC |

|

|

|

|

|

|

Volume growth |

|

|

|

3.1% |

-0.4% |

-3.5% |

-0.1% |

3.2% |

|

WACC |

12.5% |

Cost of debt |

|

|

7.0% |

|

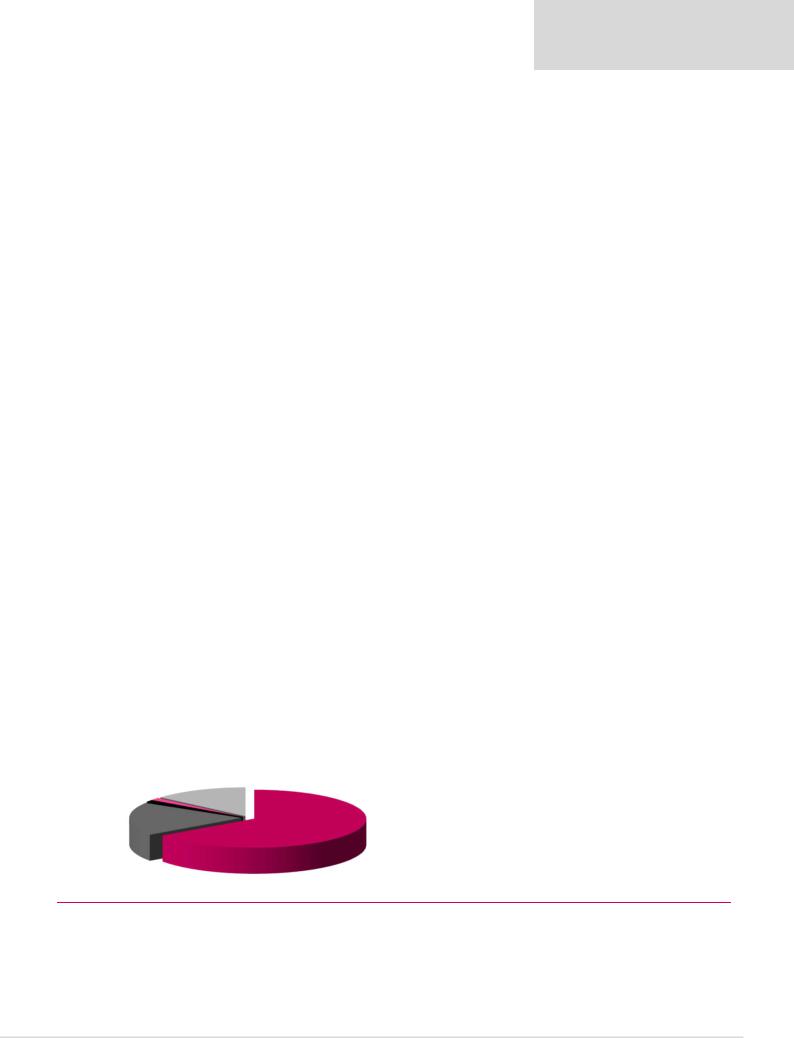

Contribution to FY18E Adjusted EBITDA |

|

|

|

|

|

|

Risk-free rate |

4.0% |

Tax rate |

|

|

30% |

||||

|

|

|

|

|

|

Equity risk premium |

7.2% |

After-tax cost of debt |

|

4.9% |

||||||

Coal |

Base metals |

|

|

|

|

|

|

Beta |

1.30 |

Debt weighting |

|

10% |

||||

|

14% |

|

|

|

|

|

|

|

Cost of equity |

13.4% |

Terminal growth rate |

|

2.0% |

|||

1% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Manganese

1%

Pellets

19%

|

Valuation ratios |

|

|

|

|

|

|

|

Dec-YE |

2016 |

2017 |

|

2018E |

2019E |

2020E |

|

P/E multiple |

5.3x |

7.1x |

|

8.7x |

6.8x |

8.6x |

|

Dividend yield |

5.3% |

2.9% |

|

2.9% |

0.0% |

0.0% |

|

EV/EBITDA |

4.4x |

4.6x |

|

4.6x |

3.8x |

4.2x |

|

P/B |

0.7x |

1.2x |

|

1.6x |

1.3x |

1.2x |

|

NAV per share, $ |

7.6 |

8.4 |

|

8.4 |

9.8 |

10.7 |

Iron ore |

Dividend policy: Minimum payment of 30% of EBITDA less sustaining capex. |

|

|

|

|||

65% |

|

|

|

||||

* Gearing defined as net debt/(net debt +equity)

Source: Bloomberg, Thomson Reuters, Company data, Renaissance Capital estimates

57

vk.com/id446425943

AngloGold Ashanti – SELL

Renaissance Capital

6 February 2019

Metals & Mining

Figure 91: AngloGold Ashanti, $mn (unless otherwise noted) |

|

|

|

|

|

|

|

|

|

|

|

||||

AngloGold Ashanti |

|

ANGJ.J |

|

|

|

|

|

Target price, ZAR: |

|

|

110 |

||||

Market capitalisation, $mn: |

|

5,920 |

|

|

|

|

|

Share price, ZAR: |

|

|

190 |

||||

Enterprise value, $mn: |

|

8,023 |

|

|

|

|

|

Potential 12-month return: |

|

-41.0% |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dec-YE |

|

|

2016 |

2017 |

2018E |

2019E |

2020E |

Dec-YE |

2016 |

2017 |

|

2018E |

2019E |

2020E |

|

Income statement |

|

|

|

|

|

|

|

Balance sheet |

|

|

|

|

|

|

|

Revenue |

|

|

4,519 |

4,809 |

4,542 |

5,209 |

5,380 |

|

Net operating assets |

5,409 |

5,506 |

|

5,253 |

5,075 |

4,961 |

Adjusted EBITDA |

|

1,770 |

1,750 |

1,731 |

2,346 |

2,230 |

|

Investments, net of rehab provision |

-739 |

-801 |

|

-712 |

-712 |

-712 |

|

Adjusted EBIT |

|

849 |

790 |

864 |

1,328 |

1,165 |

|

Equity |

2,715 |

2,663 |

|

2,745 |

3,372 |

3,873 |

|

Other items |

|

|

-343 |

-706 |

-422 |

-260 |

-274 |

|

Minority interest |

39 |

41 |

|

36 |

36 |

36 |

Net interest |

|

|

-234 |

-150 |

-142 |

-87 |

-44 |

|

Net debt |

1,916 |

2,001 |

|

1,759 |

955 |

340 |

Taxation |

|

|

-182 |

-84 |

-108 |

-294 |

-254 |

|

Balance sheet ratios |

|

|

|

|

|

|

Minority interest in profit |

|

-17 |

-20 |

-20 |

-29 |

-27 |

|

|

|

|

|

|

|

||

Net profit for the year |

|

80 |

-168 |

172 |

658 |

566 |

|

Gearing (net debt/(net debt+equity)) |

41.4% |

42.9% |

|

39.1% |

22.1% |

8.1% |

|

Headline earnings |

|

111 |

27 |

239 |

658 |

566 |

|

Net debt to EBITDA |

1.1x |

1.1x |

|

1.0x |

0.4x |

0.2x |

|

Headline EPS, USc |

|

27 |

6 |

58 |

158 |

136 |

|

RoCE |

14.1% |

13.2% |

|

14.8% |

23.6% |

21.3% |

|

|

|

RoIC (after tax) |

4.4% |

-3.9% |

|

4.3% |

13.3% |

11.2% |

|||||||

Thomson Reuters consensus HEPS, USc |

|

|

|

62 |

96 |

112 |

|

RoE |

4.3% |

1.0% |

|

8.8% |

21.5% |

15.6% |

|

DPS declared, USc |

|

10 |

5 |

8 |

16 |

12 |

|

Cash flow statement |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted EBIT |

|

|

|

|

|

|

|

Operating cash flow |

1,526 |

1,429 |

|

1,286 |

2,190 |

1,943 |

|

South Africa |

|

|

132 |

-12 |

6 |

88 |

58 |

|

Capex (net of disposals) |

-811 |

-964 |

|

-771 |

-1,005 |

-932 |

EBIT margin |

|

11% |

-1% |

1% |

14% |

10% |

|

Other cash flows |

-258 |

-466 |

|

-54 |

-260 |

-274 |

|

Continental Africa |

|

333 |

385 |

346 |

551 |

539 |

|

Free cash flow |

457 |

-1 |

|

461 |

925 |

737 |

|

EBIT margin |

|

20% |

20% |

17% |

23% |

21% |

|

Equity shareholders' cash |

274 |

-44 |

|

263 |

835 |

680 |

|

Australasia |

|

|

106 |

160 |

187 |

265 |

214 |

|

Dividends and share buy-backs |

0 |

-41 |

|

-21 |

-31 |

-65 |

EBIT margin |

|

16% |

23% |

24% |

29% |

23% |

|

Surplus (deficit) cash |

274 |

-85 |

|

242 |

804 |

615 |

|

Americas |

|

|

283 |

254 |

309 |

408 |

335 |

|

Cash flow ratios |

|

|

|

|

|

|

EBIT margin |

|

27% |

23% |

27% |

32% |

26% |

|

|

|

|

|

|

|

||

Other |

|

|

-5 |

3 |

16 |

16 |

18 |

|

Working capital turnover, days |

25 |

29 |

|

52 |

34 |

33 |

Adjusted EBIT |

|

849 |

790 |

864 |

1,328 |

1,165 |

|

FCF yield |

5.8% |

0.0% |

|

8.1% |

13.4% |

11.7% |

|

Income statement ratios |

|

|

|

|

|

|

|

Equity shareholders' yield |

4.7% |

-1.0% |

|

6.8% |

14.1% |

11.5% |

|

|

|

|

|

|

|

|

Capex/EBITDA |

45.8% |

55.1% |

|

44.5% |

42.9% |

41.8% |

||

EBITDA margin |

|

39% |

36% |

38% |

45% |

41% |

|

Cash conversion |

2.5x |

-1.6x |

|

1.1x |

1.3x |

1.2x |

|

EBIT margin |

|

19% |

16% |

19% |

25% |

22% |

|

Valuation |

|

|

|

|

|

|

|

HEPS Growth |

|

250% |

-78% |

863% |

174% |

-14% |

|

|

|

|

|

$mn |

|

||

Dividend payout ratio |

|

37% |

86% |

13% |

10% |

9% |

|

SoTP DCF fair value and calculation of TP |

|

|

|

ZAR/sh |

|||

Input assumptions |

|

|

|

|

|

|

|

South Africa |

|

|

|

|

1,050 |

36.2 |

|

|

|

|

|

|

|

|

Continental Africa |

|

|

|

|

3,939 |

135.6 |

||

Gold, $/oz |

|

|

1,248 |

1,258 |

1,269 |

1,350 |

1,338 |

|

Australasia |

|

|

|

|

1,420 |

48.9 |

ZAR/$ |

|

|

14.70 |

13.31 |

13.24 |

14.31 |

14.14 |

|

Americas |

|

|

|

|

1,726 |

59.4 |

$/AUD |

|

|

1.34 |

1.30 |

1.34 |

1.38 |

1.28 |

|

Corporate and other |

|

|

|

|

-2,100 |

-72.3 |

$/BRL |

|

|

3.49 |

3.19 |

3.65 |

3.78 |

3.50 |

|

Operating value |

|

|

|

|

6,036 |

207.8 |

$/ARS |

|

|

14.78 |

16.56 |

28.09 |

35.38 |

35.79 |

|

Financial instruments and rehab provision as at 31 December 2017 |

|

-801 |

-27.6 |

|||

Gold production volumes, koz |

|

|

|

|

|

|

|

Enterprise value |

|

|

|

|

5,235 |

180.3 |

|

|

|

|

|

|

|

|

Net debt as at 31 December 2017 |

|

|

|

|

-2,001 |

-68.9 |

||

South Africa |

lumes |

|

967 |

902 |

494 |

468 |

468 |

|

Minority interest |

|

|

|

|

-103 |

-3.5 |

Continental Africa lumes |

|

1,322 |

1,453 |

1,497 |

1,716 |

1,872 |

|

Cash used in share buy-backs during 2018E |

|

|

|

0 |

0.0 |

||

Australasia |

lumes |

|

520 |

560 |

635 |

680 |

688 |

|

Equity value |

|

|

|

|

3,131 |

107.8 |

Americas |

lumes |

|

819 |

840 |

770 |

828 |

828 |

|

|

|

|

|

|

|

|

Rounded to |

|

|

|

|

|

110.0 |

|||||||||

Total lumes |

|

3,628 |

3,755 |

3,396 |

3,692 |

3,856 |

|

Share price on13/2/2019 |

|

|

|

|

|

190.0 |

|

Volume growth |

|

-5.3% |

3.5% |

-9.6% |

8.7% |

4.4% |

|

Expected share price return |

|

|

|

|

|

-42.1% |

|

Calculated breakeven price, $/oz |

|

|

|

|

|

|

|

Plus: expected dividend yield |

|

|

|

|

|

1.1% |

|

|

|

|

|

|

|

|

Total implied one-year return |

|

|

|

|

|

-41.0% |

||

South Africa breakeven |

|

1,103 |

1,270 |

1,204 |

1,092 |

1,147 |

|

|

|

|

|

|

|

|

|

Continental Africa breakeven |

|

877 |

930 |

907 |

954 |

980 |

|

Share price range, ZAR: |

|

|

|

|

|

|

|

Australasia breakeven |

|

1,012 |

1,020 |

943 |

873 |

953 |

|

12-month high on 1-2-2019 |

192 |

12-month low on 23-5-2018 |

100 |

||||

Americas breakeven |

|

864 |

926 |

836 |

823 |

896 |

|

Price move since high |

-0.9% |

Price move since low |

|

89.6% |

|||

Group breakeven |

|

1,036 |

1,088 |

1,010 |

982 |

1,035 |

|

Calculation of WACC |

|

|

|

|

|

|

|

Contribution to FY18E underlying EBITDA |

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

WACC |

7.4% |

Cost of debt |

|

|

5.0% |

||||

|

Corporate and other |

South Africa |

|

|

|

Risk-free rate |

4.0% |

Tax rate |

|

|

30% |

||||

|

|

|

|

Equity risk premium |

5.0% After-tax cost of debt |

|

1.1% |

||||||||

|

|

|

1% |

|

5% |

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

Beta |

1.00 |

Debt weighting |

|

30% |

||

Americas |

|

|

|

|

|

|

Cost of equity |

9.0% |

Terminal growth rate |

|

2.0% |

||||

30% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Valuation ratios |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dec-YE |

2016 |

2017 |

|

2018E |

2019E |

2020E |

|

|

|

|

|

|

|

|

|

P/E multiple |

52.9x |

177.4x |

|

16.2x |

9.0x |

10.5x |

|

|

|

|

|

|

|

|

|

Dividend yield |

0.7% |

0.5% |

|

0.8% |

1.1% |

0.9% |

|

|

|

|

|

|

|

|

|

EV/EBITDA |

4.4x |

3.7x |

|

3.3x |

3.0x |

2.8x |

|

|

|

|

|

|

Continental Africa |

P/B |

2.2x |

1.7x |

|

1.4x |

1.8x |

1.5x |

||

|

Australasia |

|

|

|

NAV per share, $ |

6.6 |

6.4 |

|

6.6 |

8.1 |

9.3 |

||||

|

20% |

|

|

|

|

44% |

|

|

NAV per share, ZAR |

97 |

85 |

|

88 |

116 |

132 |

|

|

|

|

|

|

|

|

|

|||||||

Source: Bloomberg, Thomson Reuters, Renaissance Capital estimates

58