- •Contents

- •Investment summary

- •Reporting schedule

- •Earnings revisions

- •Reporting trends: 2H18E vs 2H17

- •Reporting trends 2H18E vs 1H18

- •Results previews

- •Commodity price and exchange rate forecasts

- •Peer comp charts

- •African Rainbow Minerals

- •Alrosa

- •Anglo American

- •Assore

- •Exxaro

- •Glencore

- •Kumba Iron ore

- •NorNickel

- •Rio Tinto

- •Rusal

- •Vale

- •Gold Fields

- •Harmony

- •Polymetal

- •Anglo American Platinum

- •Lonmin

- •Northam

- •Royal Bafokeng Platinum

- •Acron

- •PhosAgro

- •Evraz

- •Disclosures appendix

vk.com/id446425943

Acron – HOLD

Renaissance Capital

6 February 2019

Metals & Mining

Figure 102: Acron, RUBmn (unless otherwise noted)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Acron |

|

AKRN.MM |

|

|

|

|

|

Target price, RUB: |

|

|

4,600 |

||

Market capitalisation, RUBmn: |

|

189,569 |

|

|

|

|

|

Share price, RUB: |

|

|

4,670 |

||

Enterprise value, RUBmn: |

|

270,446 |

|

|

|

|

|

Potential 12-month return: |

|

5.4% |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dec-YE |

2016 |

2017 |

2018E |

2019E |

2020E |

Dec-YE |

2016 |

2017 |

|

2018E |

2019E |

2020E |

|

Income statement |

|

|

|

|

|

|

Balance sheet |

|

|

|

|

|

|

Revenue |

89,359 |

94,342 |

109,410 |

121,593 |

135,403 |

|

Net operating assets |

142,971 |

154,536 |

|

155,994 |

162,006 |

170,645 |

EBITDA |

29,856 |

29,817 |

38,228 |

44,623 |

50,511 |

|

Investments, net of rehab provision |

-3,266 |

-3,359 |

|

-2,394 |

-2,394 |

-2,394 |

Underlying EBIT |

23,761 |

21,860 |

28,936 |

34,642 |

39,589 |

|

Equity |

67,156 |

70,300 |

|

58,296 |

67,526 |

80,069 |

Other items |

-2,863 |

-683 |

-72 |

0 |

0 |

|

Minority interest |

20,566 |

20,656 |

|

20,668 |

20,904 |

21,180 |

Net interest |

3,814 |

-3,752 |

-8,156 |

-5,130 |

-5,190 |

|

Net debt |

51,983 |

60,221 |

|

74,636 |

71,182 |

67,003 |

Taxation |

-5,962 |

-3,500 |

-4,327 |

-5,902 |

-6,880 |

|

Balance sheet ratios |

|

|

|

|

|

|

Minority interest in profit |

630 |

-828 |

-718 |

-1,180 |

-1,376 |

|

|

|

|

|

|

|

|

Net profit for the year |

26,155 |

13,432 |

13,748 |

22,429 |

26,143 |

|

Gearing (net debt/(net debt+equity)) |

43.6% |

46.1% |

|

56.1% |

51.3% |

45.6% |

Basic EPS, RUB |

656 |

339 |

350 |

571 |

666 |

|

Net debt to EBITDA |

1.7x |

2.0x |

|

2.0x |

1.6x |

1.3x |

|

RoCE |

15.0% |

14.2% |

|

18.0% |

20.9% |

22.9% |

||||||

Thomson Reuters consensus EPS, RUB |

|

|

394 |

484 |

534 |

|

RoIC (after tax) |

13.1% |

11.1% |

|

14.7% |

16.9% |

18.5% |

DPS declared, RUB |

335 |

330 |

337 |

336 |

346 |

|

RoE |

34.4% |

19.5% |

|

21.4% |

35.7% |

35.4% |

Thomson Reuters consensus DPS, RUB |

|

|

312 |

325 |

352 |

|

Cash flow statement |

|

|

|

|

|

|

Income statement ratios |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating cash flow |

28,116 |

23,004 |

|

27,836 |

37,856 |

40,212 |

|

EBITDA margin |

33% |

32% |

35% |

37% |

37% |

|

Capex (net of disposals) |

-12,128 |

-11,299 |

|

-14,531 |

-16,155 |

-17,180 |

EBIT margin |

27% |

23% |

26% |

28% |

29% |

|

Other cash flows |

-5,812 |

-2,534 |

|

-6,305 |

0 |

0 |

EPS Growth |

79% |

-48% |

3% |

63% |

17% |

|

Free cash flow |

10,176 |

9,171 |

|

7,000 |

21,701 |

23,033 |

Dividend payout ratio (previous year) |

91% |

50% |

99% |

96% |

61% |

|

Equity shareholders' cash |

15,127 |

6,144 |

|

-774 |

16,653 |

17,780 |

Input assumptions |

|

|

|

|

|

|

Dividends and share buy-backs |

-13,787 |

-14,382 |

|

-13,641 |

-13,200 |

-13,600 |

67 |

58 |

63 |

67 |

68 |

|

Surplus (deficit) cash |

1,340 |

-8,238 |

|

-14,415 |

3,453 |

4,180 |

|

RUB/$ |

|

Cash flow ratios |

|

|

|

|

|

|

|||||

Black sea 16-16-16, $/t |

324 |

321 |

318 |

340 |

347 |

|

|

|

|

|

|

|

|

Black sea ammonia, $/t |

235 |

271 |

293 |

303 |

322 |

|

Working capital turnover, days |

45 |

54 |

|

64 |

58 |

59 |

Baltic sea Urea granular, $/t |

202 |

220 |

251 |

263 |

269 |

|

FCF yield |

4.8% |

4.2% |

|

2.6% |

7.9% |

8.5% |

MOP Potash FOB Saskatchewan, $/t |

228 |

230 |

261 |

289 |

283 |

|

Equity shareholders' yield |

10.7% |

4.5% |

|

-0.4% |

9.1% |

9.7% |

Sales volumes, kt |

|

|

|

|

|

|

Capex/EBITDA |

40.6% |

37.9% |

|

38.0% |

36.2% |

34.0% |

339 |

260 |

270 |

414 |

584 |

|

Cash conversion |

0.6x |

0.5x |

|

-0.1x |

0.7x |

0.7x |

|

Apetite |

|

Valuation |

|

|

|

|

|

|

|||||

Ammonia |

269 |

556 |

418 |

322 |

475 |

|

|

|

|

|

|

|

|

Ammonium nitrate |

1,527 |

1,233 |

1,387 |

1,224 |

1,224 |

|

DCF fair value and calculation of target price |

|

|

|

RUBmn |

RUB/sh |

|

Urea |

299 |

450 |

413 |

592 |

654 |

|

Operating value |

|

|

|

|

254,859 |

6,484 |

Urea-ammonium nitrate |

935 |

1,036 |

1,312 |

1,400 |

1,400 |

|

Financial instruments and rehab provision as at 31 December 2017 |

|

-3,359 |

-85 |

|||

NPK |

1,953 |

2,076 |

2,284 |

2,112 |

2,112 |

|

Enterprise value |

|

|

|

|

251,500 |

6,399 |

Bulk blends |

107 |

685 |

222 |

400 |

400 |

|

Net debt as at 31 December 2017 |

|

|

|

|

-60,221 |

-1,532 |

Industrial products |

923 |

984 |

1,031 |

1,025 |

1,025 |

|

Minority interest |

|

|

|

|

-20,656 |

-546 |

Total merchant sales |

6,352 |

7,279 |

7,336 |

7,488 |

7,874 |

|

Cash used in share buy-backs during 2018E |

|

|

|

-369 |

-9 |

|

Volume growth |

13.4% |

14.6% |

0.8% |

2.1% |

5.2% |

|

Market value of investment in Grupa Azoty |

|

|

|

|

12,837 |

327 |

|

|

|

|

|

|

|

Equity value |

|

|

|

|

183,091 |

4,638 |

|

|

|

|

|

|

|

Rounded to |

|

|

|

|

|

4,600 |

|

|

|

|

|

|

|

Share price on 1/2/2019 |

|

|

|

|

|

4,670 |

|

|

|

|

|

|

|

Expected share price return |

|

|

|

|

|

-1.5% |

|

|

|

|

|

|

|

Plus: expected dividend yield |

|

|

|

|

|

6.9% |

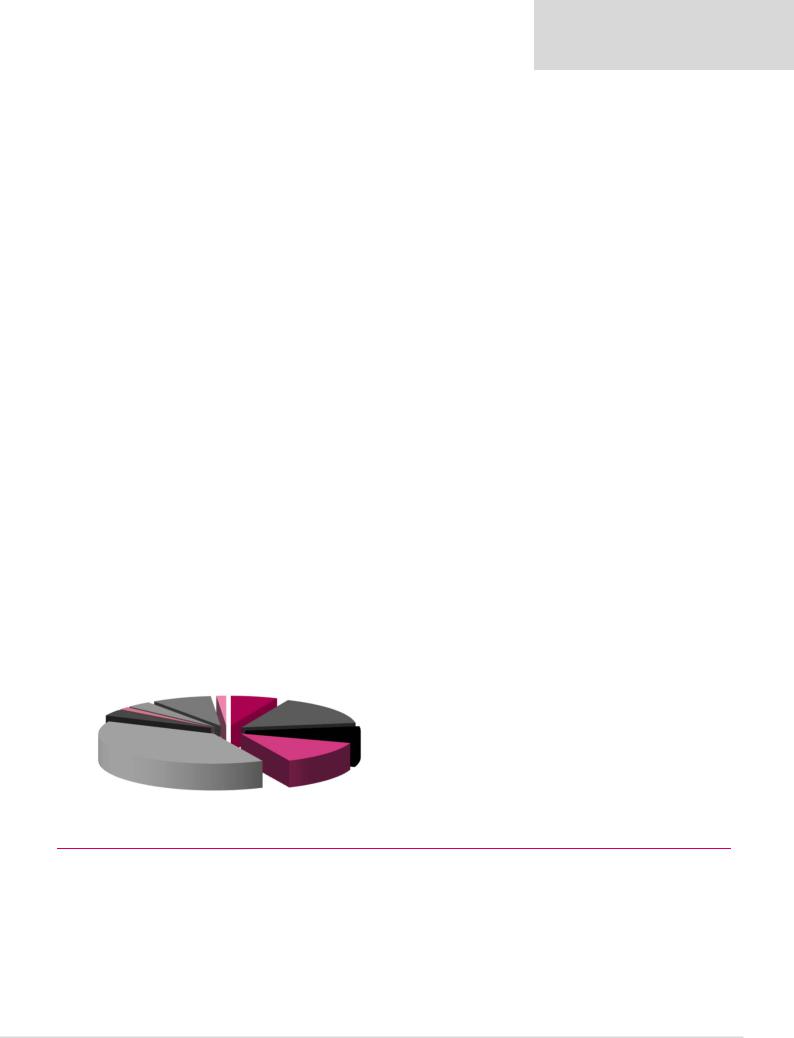

Contribution to FY18E revenue |

|

|

|

|

|

|

Total implied one-year return |

|

|

|

|

|

5.4% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Trading |

Logistics and other |

Ammonia |

|

Phosrock 4% |

Industrial products |

1% |

|

8% |

|

7% |

|

1% |

|

|

AN |

Bulk blends |

|

|

|

3% |

|

|

16% |

Urea

8%

NPK |

UAN |

|

13% |

||

39% |

||

|

Share price range, RUB: |

4,817 |

|

|

|

|

3,715 |

12-month high on 20-9-2018 |

12-month low on 10-4-2018 |

|||||

Price move since high |

-3.1% |

Price move since low |

|

25.7% |

||

Calculation of WACC |

|

|

|

|

|

|

WACC |

13.0% |

Cost of debt |

|

|

7.0% |

|

Risk-free rate |

7.0% |

Tax rate |

|

|

20% |

|

Equity risk premium |

6.0% |

After-tax cost of debt |

|

1.1% |

||

Beta |

1.30 |

Debt weighting |

|

20% |

||

Cost of equity |

14.8% |

Terminal growth rate |

|

4.0% |

||

Valuation ratios |

|

|

|

|

|

|

Dec-YE, RUBmn |

2016 |

2017 |

|

2018E |

2019E |

2020E |

P/E multiple |

5.4x |

10.1x |

|

8.7x |

8.2x |

7.0x |

Dividend yield |

9.5% |

9.6% |

|

7.7% |

7.2% |

7.4% |

EV/EBITDA |

7.1x |

7.2x |

|

7.0x |

6.2x |

5.4x |

P/B |

2.1x |

1.9x |

|

3.0x |

2.7x |

2.3x |

NAV per share, RUB |

1,687 |

1,785 |

|

1,483 |

1,718 |

2,037 |

NAV per share, USc |

2,518 |

3,060 |

|

2,363 |

2,564 |

2,996 |

Source: Bloomberg, Thomson Reuters, Company data, Renaissance Capital estimates

69