- •Contents

- •Investment stance

- •Fears of an economic slowdown

- •Capital cycle favours rising returns

- •Management remains focused on value-creation

- •Comfortable balance sheets and supportive dividend potential

- •Value relative to other stocks

- •Positive earnings momentum

- •Commodity price revisions

- •Preference for base metals over steelmaking materials

- •Steel

- •Metallurgical coal

- •Iron ore

- •Manganese ore

- •Copper

- •Aluminium

- •Nickel

- •Zinc

- •Diamonds

- •Thermal coal

- •Platinum group metals (13mn oz)

- •Gold

- •Our long-term commodity prices should not incentivise over-supply

- •Earnings revisions

- •Risks and catalysts

- •Peer comp charts

- •Commodity price and exchange rate forecasts

- •Important publications

- •African Rainbow Minerals

- •Alrosa

- •Anglo American

- •Assore

- •Exxaro

- •Glencore

- •Kumba Iron Ore

- •Rio Tinto

- •Vale

- •Gold Fields

- •Harmony

- •Polymetal

- •Anglo American Platinum

- •Lonmin

- •Northam

- •Royal Bafokeng Platinum

- •Merafe Resources

- •Evraz

- •Severstal

- •Disclosures appendix

vk.com/id446425943

Anglo American Platinum – HOLD

Renaissance Capital

14 January 2019

Metals & Mining

Figure 108: Anglo American Platinum, ZARmn (unless otherwise stated)

|

|

|

|

Anglo American Platinum |

AMSJ.J |

Target price, ZAR: |

540 |

Market capitalisation, ZARmn: |

147,157 |

Last price, ZAR: |

549 |

Enterprise value, ZARmn: |

148,464 |

Potential 12-month return: |

0.5% |

Dec-YE |

2016 |

2017 |

|

2018E |

2019E |

2020E |

Income statement |

|

|

|

|

|

|

Revenue |

61,944 |

65,671 |

|

74,708 |

85,729 |

88,974 |

EBITDA |

9,168 |

12,367 |

|

16,216 |

20,511 |

21,897 |

EBIT |

4,501 |

8,274 |

|

12,065 |

16,033 |

17,227 |

Net interest |

-1,153 |

-951 |

|

-95 |

-213 |

87 |

Taxation |

-364 |

-1,616 |

|

-3,022 |

-4,904 |

-5,367 |

Equity accounted income |

-115 |

-362 |

|

48 |

0 |

0 |

Attributable profit |

552 |

1,945 |

|

6,844 |

10,848 |

11,854 |

Headline earnings |

1,867 |

3,886 |

|

8,027 |

10,848 |

11,854 |

HEPS, ZAc |

713 |

1,482 |

|

3,018 |

4,037 |

4,412 |

Thomson Reuters consensus HEPS, ZAc |

|

|

|

2,610 |

3,009 |

3,608 |

DPS declared, ZAc |

0 |

349 |

|

895 |

1,211 |

1,323 |

Breakdown of EBIT |

4,785 |

7,029 |

|

7,894 |

9,938 |

10,090 |

Mogalakwena |

|

|||||

EBIT margin |

34% |

44% |

|

41% |

46% |

46% |

Amandelbult |

1,293 |

1,699 |

|

3,208 |

4,570 |

5,195 |

EBIT margin |

12% |

15% |

|

23% |

30% |

33% |

Unki |

22 |

369 |

|

351 |

545 |

656 |

EBIT margin |

1% |

15% |

|

14% |

19% |

22% |

JV operations |

626 |

659 |

|

1,834 |

2,684 |

2,479 |

EBIT margin |

10% |

11% |

|

23% |

26% |

24% |

Third party |

1,319 |

2,104 |

|

2,722 |

3,068 |

3,175 |

EBIT margin |

9% |

8% |

|

9% |

9% |

8% |

Other |

-3,544 |

-3,586 |

|

-3,945 |

-4,772 |

-4,368 |

EBIT |

4,501 |

8,274 |

|

12,065 |

16,033 |

17,227 |

Income statement ratios |

|

|

|

|

|

|

EBITDA margin |

15% |

19% |

|

22% |

24% |

25% |

EBIT margin |

7% |

13% |

|

16% |

19% |

19% |

HEPS growth |

1626% |

108% |

|

104% |

34% |

9% |

Dividend payout ratio |

0% |

47% |

|

35% |

30% |

30% |

Input assumptions |

|

|

|

|

|

|

Platinum, $/oz |

988 |

950 |

|

880 |

870 |

1,070 |

Palladium, $/oz |

614 |

871 |

|

1,030 |

1,216 |

1,088 |

Rhodium, $/oz |

694 |

1,108 |

|

2,218 |

2,379 |

2,163 |

USD/ZAR |

14.70 |

13.31 |

|

13.24 |

14.31 |

14.14 |

Sales volumes, koz |

|

|

|

|

|

|

Mined platinum |

1,809 |

1,389 |

|

1,328 |

1,399 |

1,369 |

Third party platinum |

652 |

1,066 |

|

1,172 |

1,201 |

1,221 |

Total platinum sales |

2,416 |

2,505 |

|

2,466 |

2,600 |

2,591 |

Volume growth |

-2.2% |

3.7% |

|

-1.6% |

5.4% |

-0.4% |

3PGM breakeven price, $/oz |

|

|

|

|

|

|

Mogalakwena breakeven |

530 |

430 |

|

533 |

492 |

517 |

Amandelbult breakeven |

684 |

761 |

|

727 |

712 |

704 |

Unki breakeven |

699 |

660 |

|

751 |

775 |

770 |

JV operations breakeven |

702 |

788 |

|

746 |

770 |

837 |

Group (mined production) breakeven |

754 |

744 |

|

744 |

743 |

756 |

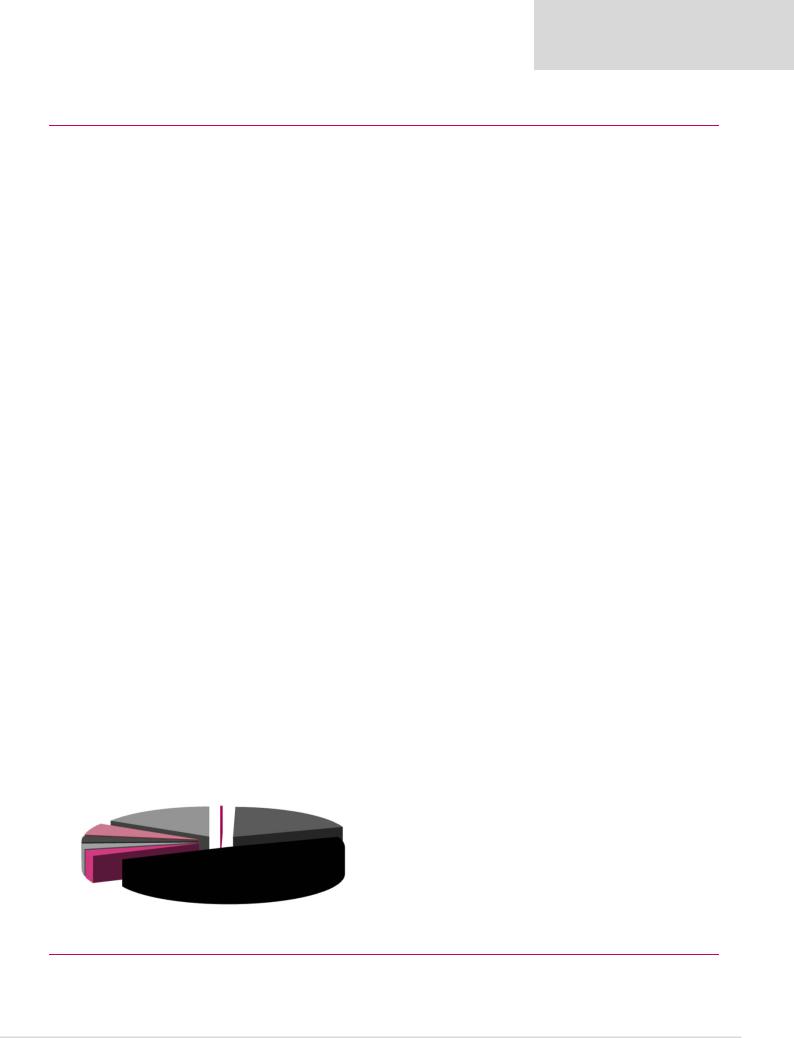

Contribution to FY18E underlying EBITDA |

|

|

|

|

|

|

Third party |

Union |

|

|

Amandelbult |

|

|

16% |

|

|

|

19% |

|

|

1% |

|

|

|

|

||

Kroondal |

|

|

|

|

|

|

|

|

|

|

|

|

|

6% |

|

|

|

|

|

|

Mototolo |

|

|

|

|

|

|

3% |

|

|

|

|

|

|

Modikwa |

|

Mogalakwena |

|

|

||

3% |

|

|

49% |

|

|

|

Unki

3%

Dec-YE |

|

|

|

|

2018E |

2019E |

2020E |

|

2016 |

2017 |

|

||||

Balance sheet |

|

|

|

|

|

|

|

Net operating assets |

|

44,516 |

40,109 |

|

44,433 |

46,051 |

47,684 |

Investments |

|

2,585 |

2,725 |

|

2,341 |

2,388 |

2,436 |

Equity |

|

40,016 |

41,527 |

|

46,773 |

54,609 |

63,048 |

Minority interest |

|

-234 |

-526 |

|

259 |

259 |

259 |

Net debt |

|

7,319 |

1,833 |

|

-258 |

-6,429 |

-13,187 |

Balance sheet ratios |

|

|

|

|

|

|

|

Gearing (net debt/(net debt+equity)) |

|

15.5% |

4.2% |

|

-0.6% |

-13.3% |

-26.4% |

Net debt to EBITDA |

|

0.8x |

0.1x |

|

0.0x |

-0.3x |

-0.6x |

RoCE |

|

8.1% |

16.6% |

|

24.1% |

30.0% |

31.2% |

RoIC (after tax) |

|

4.0% |

11.9% |

|

18.4% |

21.3% |

21.9% |

RoE |

|

4.7% |

9.5% |

|

18.2% |

21.4% |

20.1% |

Cash flow statement |

|

|

|

|

|

|

|

Operating cash flow |

|

11,030 |

9,486 |

|

12,597 |

16,644 |

17,092 |

Capex (net of disposals) |

|

-4,695 |

-4,744 |

|

-6,271 |

-6,523 |

-6,219 |

Other |

|

1,399 |

1,841 |

|

-3,267 |

-670 |

-622 |

FCF |

|

7,734 |

6,583 |

|

3,059 |

9,451 |

10,252 |

Equity shareholders' cash |

|

5,450 |

5,486 |

|

4,024 |

9,183 |

10,173 |

Dividends and share buy backs |

|

0 |

0 |

|

-1,933 |

-3,012 |

-3,415 |

Movement in net debt |

|

5,450 |

5,486 |

|

2,091 |

6,171 |

6,758 |

Cash flow ratios |

|

|

|

|

|

|

|

Working capital turnover, days |

|

49 |

52 |

|

51 |

46 |

47 |

FCF yield |

|

7.8% |

7.3% |

|

2.9% |

6.7% |

7.6% |

Equity shareholders' yield |

|

5.9% |

6.2% |

|

3.8% |

6.2% |

6.9% |

Capex/EBITDA |

|

44.9% |

36.0% |

|

37.7% |

30.2% |

27.2% |

Cash conversion |

|

2.9x |

1.4x |

|

0.5x |

0.8x |

0.9x |

Valuation |

|

|

|

|

|

|

|

SoTP DCF fair value and calculation of target price |

|

|

|

ZARmn |

ZAR/sh |

||

Union mine |

|

|

|

|

23 |

0 |

|

Amandelbult operations |

|

|

|

|

33,070 |

123 |

|

Mogalakwena mine |

|

|

|

|

103,614 |

386 |

|

Twickenham mine |

|

|

|

|

-428 |

-2 |

|

Unki mine |

|

|

|

|

6,793 |

25 |

|

Modikwa |

|

|

|

|

4,138 |

15 |

|

Mototolo |

|

|

|

|

3,561 |

13 |

|

Kroondal |

|

|

|

|

2,697 |

10 |

|

Third party sales |

|

|

|

|

8,857 |

33 |

|

Other |

|

|

|

|

-17,678 |

-66 |

|

Enterprise value |

|

|

|

|

144,648 |

540 |

|

Investments as at 31 December 2017 |

|

|

|

|

2,725 |

10 |

|

Net debt as at 31 December 2017 |

|

|

|

|

-1,833 |

-7 |

|

Cash used in share buy-backs during 2018E |

|

|

|

|

0 |

0 |

|

Equity value |

|

|

|

|

145,540 |

543 |

|

Rounded to |

|

|

|

|

|

540 |

|

Current share price on 7/1/2019 |

|

|

|

|

|

549.3 |

|

Expected share price return |

|

|

|

|

|

-1.7% |

|

Plus: expected dividend yield |

|

|

|

|

|

2.2% |

|

Total implied one-year return |

|

|

|

|

|

0.5% |

|

Share price range, ZAR: |

|

|

|

|

|

|

|

12-month high |

552 |

12-month low |

|

299 |

|||

Price move since high |

-0.6% |

Price move since low |

|

83.8% |

|||

Calculation of WACC |

|

|

|

|

|

|

|

WACC |

11.4% |

Cost of debt |

|

|

10.0% |

||

Risk-free rate |

9.0% |

Tax rate |

|

|

28% |

||

Equity risk premium |

4.0% |

After-tax cost of debt |

|

7.2% |

|||

Beta |

1.30 |

Debt weighting |

|

40% |

|||

Cost of equity |

14.2% |

Terminal growth rate |

|

6.0% |

|||

Valuation ratios |

|

|

|

|

|

|

|

Dec-YE |

|

2016 |

2017 |

|

2018E |

2019E |

2020E |

P/E multiple |

|

48.5x |

22.4x |

|

13.1x |

13.6x |

12.5x |

Dividend yield |

|

0.0% |

1.1% |

|

2.3% |

2.2% |

2.4% |

EV/EBITDA |

|

9.5x |

6.8x |

|

6.4x |

6.5x |

5.9x |

P/B |

|

2.3x |

2.1x |

|

2.3x |

2.7x |

2.3x |

NAV per share, ZAR |

|

149 |

155 |

|

174 |

204 |

235 |

Source: Bloomberg, Thomson Reuters, Renaissance Capital estimates

73

vk.com/id446425943

Impala Platinum – BUY

Renaissance Capital

14 January 2019

Metals & Mining

Figure 109: Impala Platinum, ZARmn (unless otherwise stated)

Impala Platinum |

IMPJ.J |

Target price, ZAR: |

45 |

Market capitalisation, ZARmn: |

30,421 |

Last price, ZAR: |

38 |

Enterprise value, ZARmn: |

39,448 |

Potential 12-month return: |

19.9% |

Jun-YE |

2017 |

2018 |

2019E |

2020E |

2021E |

Income statement |

|

|

|

|

|

Revenue |

40,540 |

39,587 |

41,506 |

53,956 |

51,383 |

Underlying EBITDA |

3,622 |

5,884 |

8,743 |

9,933 |

11,658 |

Underlying EBIT |

-474 |

1,684 |

4,957 |

6,192 |

8,331 |

Net interest |

-400 |

-701 |

-614 |

-324 |

-37 |

Taxation |

2,461 |

2,042 |

-1,216 |

-1,643 |

-2,322 |

Minority interest in profit |

122 |

-114 |

-307 |

-352 |

-339 |

Attributable profit |

-7,976 |

-10,907 |

2,820 |

3,873 |

5,632 |

Headline earnings |

-983 |

-1,228 |

2,820 |

3,873 |

5,632 |

HEPS, ZAc |

-137 |

-171 |

392 |

539 |

784 |

Thomson Reuters consensus HEPS, ZAc |

|

|

189 |

272 |

410 |

DPS declared, ZAc |

0 |

0 |

0 |

0 |

0 |

Underlying EBIT |

-1,760 |

-1,083 |

1,576 |

2,126 |

4,245 |

Rustenburg lease |

|||||

EBIT margin |

-6% |

-4% |

5% |

6% |

13% |

Zimplats |

1,169 |

1,911 |

2,069 |

2,613 |

2,775 |

EBIT margin |

17% |

26% |

25% |

28% |

29% |

Marula |

-627 |

-6 |

220 |

172 |

-5 |

EBIT margin |

-39% |

0% |

8% |

6% |

0% |

Mimosa |

2 |

320 |

235 |

346 |

386 |

EBIT margin |

0% |

16% |

11% |

15% |

16% |

Two Rivers |

460 |

419 |

684 |

753 |

735 |

EBIT margin |

24% |

23% |

32% |

32% |

31% |

Other |

282 |

123 |

173 |

182 |

196 |

EBIT |

-474 |

1,684 |

4,957 |

6,192 |

8,331 |

Income statement ratios |

|

|

|

|

|

EBITDA margin |

9% |

15% |

21% |

18% |

23% |

EBIT margin |

-1% |

4% |

12% |

11% |

16% |

HEPS growth |

-1242% |

-25% |

329% |

37% |

45% |

Dividend payout ratio |

0% |

0% |

0% |

0% |

0% |

Input assumptions |

|

|

|

|

|

Platinum, $/oz |

988 |

940 |

820 |

970 |

1,134 |

Palladium, $/oz |

738 |

977 |

1,151 |

1,152 |

1,050 |

Rhodium, $/oz |

821 |

1,634 |

2,440 |

2,271 |

2,098 |

USD/ZAR |

13.60 |

12.85 |

14.25 |

14.25 |

14.09 |

Production volumes, koz |

|

|

|

|

|

Mined platinum |

1,121 |

1,048 |

1,159 |

1,144 |

1,004 |

Third party platinum |

244 |

241 |

180 |

180 |

180 |

Joint venture platinum |

165 |

180 |

145 |

149 |

149 |

Gross refined platinum |

1,530 |

1,468 |

1,484 |

1,473 |

1,333 |

Volume growth |

6.4% |

-4.0% |

1.1% |

-0.7% |

-9.5% |

3PGM breakeven price, $/oz |

|

|

|

|

|

Rustenburg lease breakeven |

1,071 |

1,183 |

1,066 |

1,123 |

982 |

Zimplats breakeven |

653 |

783 |

765 |

781 |

807 |

Marula breakeven |

1,201 |

970 |

962 |

1,053 |

1,158 |

Mimosa breakeven |

888 |

896 |

934 |

956 |

978 |

Two Rivers breakeven |

677 |

797 |

717 |

758 |

807 |

Group (mined production) breakeven |

895 |

959 |

902 |

941 |

876 |

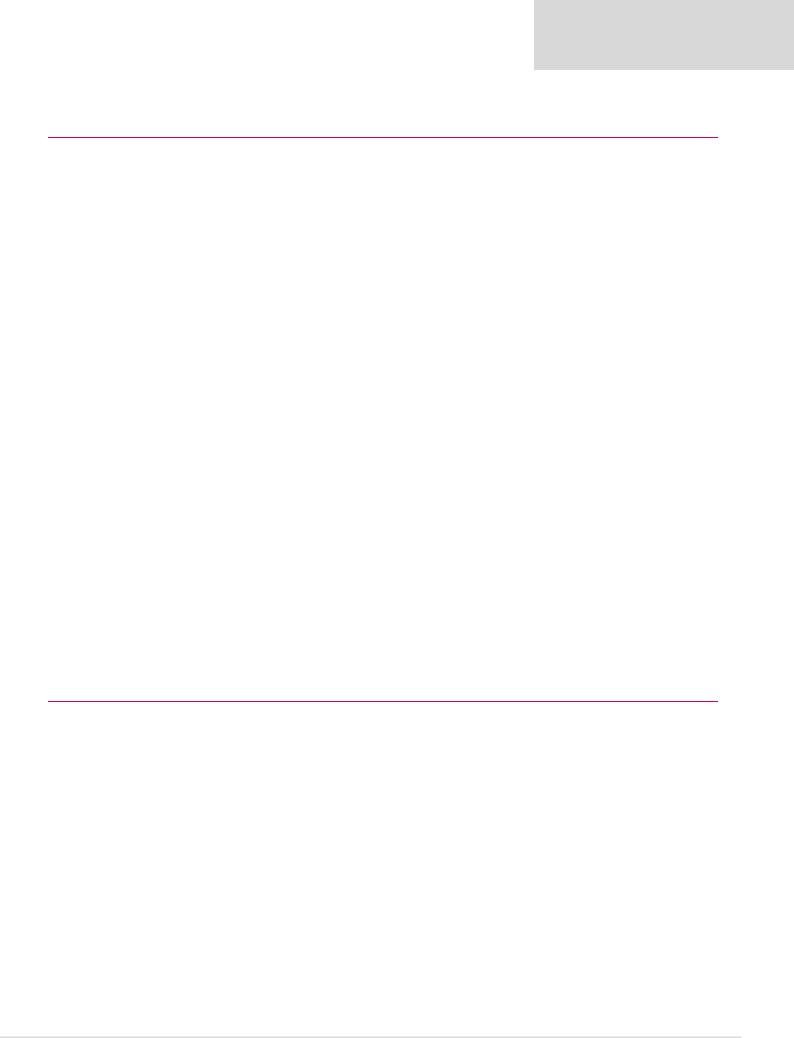

Contribution to FY19E proportionately consolidated underlying EBITDA |

|

||||

Two Rivers |

|

|

|

|

|

10% |

|

|

|

Rustenburg Lease |

|

Mimosa |

|

|

|

||

6% |

|

|

|

46% |

|

IRS 1%

Zimplats

37%

Jun-YE |

|

|

|

|

2019E |

2020E |

2021E |

|

2017 |

2018 |

|

||||

Balance sheet |

|

|

|

|

|

|

|

Net operating assets |

|

51,832 |

45,914 |

|

44,722 |

45,490 |

46,964 |

Investments |

|

-929 |

326 |

|

333 |

339 |

346 |

Equity |

|

46,807 |

37,213 |

|

40,033 |

43,906 |

49,538 |

Minority interest |

|

2,425 |

2,380 |

|

2,380 |

2,380 |

2,380 |

Net debt (including finance leases) |

|

1,671 |

6,647 |

|

2,642 |

-457 |

-4,608 |

Balance sheet ratios |

|

|

|

|

|

|

|

Gearing (net debt/(net debt+equity)) |

|

3.4% |

15.2% |

|

6.2% |

-1.1% |

-10.3% |

Net debt to EBITDA |

|

0.5x |

1.1x |

|

0.3x |

0.0x |

-0.4x |

RoCE |

|

-0.8% |

3.2% |

|

10.5% |

13.1% |

17.3% |

RoIC (after tax) |

|

-8.5% |

-5.9% |

|

7.6% |

9.5% |

12.5% |

RoE |

|

-1.9% |

-2.9% |

|

7.3% |

9.2% |

12.1% |

Cash flow statement |

|

|

|

|

|

|

|

Operating cash flow |

|

-1,247 |

-1,256 |

|

9,436 |

7,810 |

8,031 |

Capex (net of disposals) |

|

-3,798 |

-5,106 |

|

-4,675 |

-4,119 |

-3,506 |

Other |

|

3,856 |

3,305 |

|

0 |

0 |

0 |

FCF |

|

-1,189 |

-3,057 |

|

4,761 |

3,690 |

4,525 |

Equity shareholders' cash |

|

846 |

-4,976 |

|

4,005 |

3,099 |

4,152 |

Dividends and share buy backs |

|

0 |

0 |

|

0 |

0 |

0 |

Movement in net debt |

|

846 |

-4,976 |

|

4,005 |

3,099 |

4,152 |

Cash flow ratios |

|

|

|

|

|

|

|

Working capital turnover, days |

|

58 |

81 |

|

49 |

48 |

60 |

FCF yield |

|

-2.9% |

-9.8% |

|

14.9% |

12.8% |

18.3% |

Equity shareholders' yield |

|

2.3% |

-22.3% |

|

14.8% |

11.5% |

15.4% |

Capex/EBITDA |

|

104.9% |

86.8% |

|

53.5% |

41.5% |

30.1% |

Cash conversion |

|

-0.9x |

4.1x |

|

1.4x |

0.8x |

0.7x |

Valuation |

|

|

|

|

|

|

|

SoTP DCF fair value and calculation of target price |

|

|

|

ZARmn |

ZAR/sh |

||

Rustenburg lease |

|

|

|

|

19,754 |

27.5 |

|

Zimplats (effective interest = 87%) |

|

|

|

|

14,791 |

20.6 |

|

Marula (effective interest = 73%) |

|

|

|

|

-279 |

-0.4 |

|

Afplats (effective interest = 74%) |

|

|

|

|

0 |

0.0 |

|

IRS (third party only) |

|

|

|

|

205 |

0.3 |

|

Mimosa (effective interest = 50%) |

|

|

|

|

1,700 |

2.4 |

|

Two Rivers (effective interest = 46%) |

|

|

|

|

4,801 |

6.7 |

|

Chrome operations |

|

|

|

|

404 |

0.6 |

|

Enterprise value |

|

|

|

|

41,375 |

57.6 |

|

Investments as at 30 June 2018 |

|

|

|

|

326 |

0.5 |

|

Net debt as at 30 June 2018 |

|

|

|

|

-6,647 |

-9.2 |

|

Cash used in share buy-backs during 2019E |

|

|

|

|

0 |

0.0 |

|

Convertible debt conversion cost at ZAR50/share |

|

|

|

-1,585 |

-2.2 |

||

Anticipated indigenization discount of Zimplats and Mimosa |

|

-841 |

-1.2 |

||||

Equity value |

|

|

|

|

32,628 |

45.4 |

|

Rounded to |

|

|

|

|

|

45.0 |

|

Current share price on 7/1/2019 |

|

|

|

|

|

37.5 |

|

Expected share price return |

|

|

|

|

|

19.9% |

|

Plus: expected dividend yield |

|

|

|

|

|

0.0% |

|

Total implied one-year return |

|

|

|

|

|

19.9% |

|

Share price range, ZAR: |

|

|

|

|

|

|

|

12-month high |

39 |

12-month low |

|

16 |

|||

Price move since high |

-3.2% |

Price move since low |

|

140.5% |

|||

Calculation of WACC |

|

|

|

|

|

|

|

WACC |

15.4% |

Cost of debt |

|

|

10.0% |

||

Risk-free rate |

9.0% |

Tax rate |

|

|

28% |

||

Equity risk premium |

6.0% |

After-tax cost of debt |

|

7.2% |

|||

Beta |

1.30 |

Debt weighting |

|

15% |

|||

Cost of equity |

16.8% |

Terminal growth rate |

|

0.0% |

|||

Valuation ratios |

|

|

|

|

|

|

|

Jun-YE |

|

2017 |

2018 |

|

2019E |

2020E |

2021E |

P/E multiple |

|

-36.6x |

-18.2x |

|

9.6x |

7.0x |

4.8x |

Dividend yield |

|

0.0% |

0.0% |

|

0.0% |

0.0% |

0.0% |

EV/EBITDA |

|

11.3x |

5.3x |

|

3.7x |

2.9x |

2.1x |

P/B |

|

0.8x |

0.6x |

|

0.7x |

0.6x |

0.5x |

NAV per share, ZAR |

|

64 |

52 |

|

56 |

61 |

69 |

Source: Bloomberg, Thomson Reuters, Renaissance Capital estimates

74

vk.com/id446425943

Lonmin – SELL

Renaissance Capital

14 January 2019

Metals & Mining

Figure 110: Lonmin, $mn (unless otherwise stated)

|

|

|

|

Lonmin |

LONJ.J |

Target price, ZAR: |

7.0 |

Market capitalisation, $mn: |

187 |

Last price, ZAR: |

9.1 |

Enterprise value, $mn: |

73 |

Potential 12-month return: |

-23.3% |

Sep-YE |

2017 |

2018 |

2019E |

2020E |

2021E |

Income statement |

|

|

|

|

|

Revenue |

1,166 |

1,345 |

1,340 |

1,155 |

1,123 |

Underlying EBITDA |

38 |

115 |

231 |

144 |

73 |

Underlying EBIT |

-28 |

101 |

212 |

121 |

47 |

Net interest |

-88 |

-30 |

-13 |

-5 |

-6 |

Taxation |

18 |

-6 |

-56 |

-32 |

-11 |

Minority interest profit |

156 |

-20 |

-20 |

-11 |

-4 |

Attributable profit |

-998 |

42 |

124 |

72 |

25 |

Underlying earnings |

-103 |

63 |

124 |

72 |

25 |

Underlying EPS, USc |

-37 |

22 |

44 |

25 |

9 |

- ZAR |

-4.87 |

3.06 |

6.30 |

3.60 |

1.30 |

Thomson Reuters consensus HEPS, ZAR |

|

|

1.61 |

1.70 |

1.72 |

DPS declared, USc |

0 |

0 |

0 |

0 |

0 |

Income statement ratios |

|

|

|

|

|

EBITDA margin |

3% |

9% |

17% |

12% |

6% |

EBIT margin |

-2% |

8% |

16% |

10% |

4% |

EPS growth |

-3% |

161% |

97% |

-42% |

-64% |

Dividend payout ratio |

0% |

0% |

0% |

0% |

0% |

Input assumptions |

|

|

|

|

|

Platinum, $/oz |

955 |

905 |

840 |

1,020 |

1,149 |

Palladium, $/oz |

794 |

990 |

1,212 |

1,120 |

1,045 |

Rhodium, $/oz |

927 |

1,957 |

2,435 |

2,217 |

2,089 |

USD/ZAR |

13.38 |

13.07 |

14.31 |

14.20 |

14.11 |

Breakeven price, $/3PGMoz |

927 |

992 |

967 |

1,096 |

1,207 |

Platinum volumes, koz |

|

|

|

|

|

Metal in concentrate |

644 |

629 |

640 |

520 |

500 |

Gross refined |

688 |

666 |

658 |

538 |

518 |

Sales |

706 |

676 |

658 |

538 |

518 |

Volume growth |

-4.0% |

-4.3% |

-2.7% |

-18.2% |

-3.7% |

Balance sheet |

|

|

|

|

|

Net operating assets |

363 |

440 |

581 |

660 |

745 |

Investments less rehab provision |

-100 |

-97 |

-97 |

-97 |

-97 |

Equity |

685 |

757 |

881 |

952 |

978 |

Minority interest |

-323 |

-300 |

-280 |

-269 |

-265 |

Net debt |

-99 |

-114 |

-117 |

-121 |

-65 |

Balance sheet ratios |

|

|

|

|

|

Gearing (net debt/(net debt+equity)) |

-16.9% |

-17.7% |

-15.2% |

-14.6% |

-7.1% |

Net debt to EBITDA |

-2.6x |

-1.0x |

-0.5x |

-0.8x |

-0.9x |

RoCE |

-2.1% |

12.0% |

41.5% |

19.5% |

6.6% |

RoIC (after tax) |

-4.6% |

9.9% |

29.9% |

14.0% |

4.8% |

RoE |

-8.8% |

8.7% |

15.1% |

7.8% |

2.6% |

|

|

|

|

|

|

Sep-YE |

|

|

|

2019E |

2020E |

2021E |

2017 |

2018 |

|

||||

Cash flow statement |

|

|

|

|

|

|

Operating cash flow |

79 |

140 |

|

117 |

115 |

51 |

Capex (net of disposals) |

-100 |

-73 |

|

-110 |

-110 |

-102 |

Other |

20 |

-34 |

|

4 |

4 |

0 |

FCF |

-1 |

33 |

|

12 |

8 |

-52 |

Equity shareholders' cash |

-70 |

11 |

|

3 |

4 |

-56 |

Dividends and share buy backs |

0 |

0 |

|

0 |

0 |

0 |

Movement in net debt |

-70 |

11 |

|

3 |

4 |

-56 |

Cash flow ratios |

31 |

21 |

|

36 |

41 |

45 |

Working capital turnover, days |

|

|||||

FCF yield |

0% |

45% |

|

17% |

13% |

-43% |

Equity shareholders' yield |

-17% |

6% |

|

1% |

2% |

-30% |

Capex/EBITDA |

263% |

63% |

|

47% |

77% |

141% |

Cash conversion |

0.7x |

0.2x |

|

0.0x |

0.1x |

-2.2x |

Valuation |

|

|

|

|

|

|

Calculation of target price |

|

|

|

|

|

ZAR/sh |

DCF fair value per share |

|

|

|

|

|

-0.3 |

Smelting and refining value per share |

|

|

|

|

|

7.0 |

Total value per share |

|

|

|

|

|

6.7 |

Rounded to |

|

|

|

|

|

7.0 |

Current share price on 7/1/2019 |

|

|

|

|

|

9.1 |

Expected share price return |

|

|

|

|

|

-23.3% |

Plus: expected dividend yield |

|

|

|

|

|

0.0% |

Total implied one-year return |

|

|

|

|

|

-23.3% |

Implied Lonmin share price based on Sibanye's proposed offer |

|

|

ZAR/sh |

|||

At share exchange ratio of 0.967 and assuming market values on 7/1/2019 |

|

10.1 |

||||

Share price range, ZAR: |

|

|

|

|

|

|

12-month high |

15 |

12-month low |

|

7 |

||

Price move since high |

-41.0% Price move since low |

|

40.5% |

|||

Calculation of WACC |

|

|

|

|

|

|

WACC |

11.0% |

Cost of debt |

|

|

5.0% |

|

Risk-free rate |

4.0% |

Tax rate |

|

|

28% |

|

Equity risk premium |

6.0% |

After-tax cost of debt |

|

3.6% |

||

Beta |

1.30 |

Debt weighting |

|

10% |

||

Cost of equity |

11.8% |

Terminal growth rate |

|

0.0% |

||

Valuation ratios |

|

|

|

|

|

|

Sep-YE |

2017 |

2018 |

|

2019E |

2020E |

2021E |

P/E multiple |

-4.1x |

3.0x |

|

1.5x |

2.6x |

7.3x |

Dividend yield |

0.0% |

0.0% |

|

0.0% |

0.0% |

0.0% |

EV/EBITDA |

0.0x |

-2.0x |

|

-0.9x |

-1.4x |

-2.0x |

P/B |

0.6x |

0.2x |

|

0.2x |

0.2x |

0.2x |

NAV per share, ZAR |

32 |

35 |

|

45 |

48 |

49 |

Source: Bloomberg, Thomson Reuters, Renaissance Capital estimates

75

vk.com/id446425943

Northam Platinum – SELL

Renaissance Capital

14 January 2019

Metals & Mining

Figure 111: Northam Platinum, ZARmn (unless otherwise stated)

|

|

|

|

Northam |

NHMJ.J |

Target price, ZAR: |

40 |

Market capitalisation, ZARmn: |

21,574 |

Last price, ZAR: |

43 |

Enterprise value, ZARmn: |

27,168 |

Potential 12-month return: |

-6.1% |

Jun-YE |

|

2017 |

2018 |

2019E |

2020E |

2021E |

Income statement |

|

|

|

|

|

|

Revenue |

|

6,865 |

7,553 |

14,328 |

14,251 |

15,956 |

Underlying EBITDA |

|

1,068 |

1,268 |

3,136 |

4,027 |

4,794 |

Underlying EBIT |

|

616 |

826 |

2,470 |

3,410 |

4,154 |

Equity accounted income |

|

5 |

4 |

0 |

0 |

0 |

Net interest |

|

-984 |

-1,137 |

-1,467 |

-1,623 |

-1,800 |

Other operating items |

|

-57 |

-164 |

-331 |

-342 |

-356 |

Taxation |

|

-212 |

-232 |

-564 |

-834 |

-1,050 |

Minority interest in profit |

|

0 |

0 |

0 |

0 |

0 |

Attributable profit |

|

-634 |

-702 |

108 |

611 |

948 |

Headline earnings |

|

-635 |

-699 |

108 |

611 |

948 |

HEPS, ZAc |

|

-182 |

-201 |

31 |

175 |

271 |

Normalised HEPS, ZAc |

|

78 |

83 |

288 |

424 |

533 |

Thomson Reuters consensus HEPS, ZAc |

|

|

-70 |

54 |

365 |

|

DPS declared, ZAc |

|

0 |

0 |

0 |

0 |

0 |

Underlying EBIT |

|

177 |

298 |

1,044 |

1,420 |

1,468 |

Zondereinde operations |

|

|||||

EBIT margin |

|

4% |

7% |

11% |

17% |

17% |

Booysendal operations |

|

437 |

525 |

1,427 |

1,990 |

2,687 |

EBIT margin |

|

17% |

17% |

31% |

33% |

37% |

EBIT |

|

616 |

826 |

2,470 |

3,410 |

4,154 |

Income statement ratios |

|

|

|

|

|

|

EBITDA margin |

|

16% |

17% |

22% |

28% |

30% |

EBIT margin |

|

9% |

11% |

17% |

24% |

26% |

HEPS growth |

|

-29% |

-10% |

115% |

466% |

55% |

Dividend payout ratio |

|

0% |

0% |

0% |

0% |

0% |

Input assumptions |

|

|

|

|

|

|

Platinum, $/oz |

|

988 |

940 |

820 |

970 |

1,134 |

Palladium, $/oz |

|

738 |

977 |

1,151 |

1,152 |

1,050 |

Rhodium, $/oz |

|

821 |

1,634 |

2,440 |

2,271 |

2,098 |

$/ZAR |

|

13.60 |

12.85 |

14.25 |

14.25 |

14.09 |

3PGM sales volumes (excl. third party) |

|

|

|

|

|

|

Zondereinde operations |

lumes |

230 |

178 |

469 |

347 |

347 |

Booysendal operations |

lumes |

188 |

199 |

264 |

331 |

397 |

Group |

|

418 |

377 |

732 |

678 |

744 |

Volume growth |

|

-0.5% |

-9.7% |

94.2% |

-7.4% |

9.7% |

3PGM breakeven price, $/oz |

832 |

921 |

867 |

867 |

902 |

|

Zondereinde operations |

|

|||||

Booysendal operations |

|

653 |

741 |

653 |

700 |

697 |

Group (mined production) |

751 |

826 |

790 |

785 |

792 |

|

Contribution to FY19E underlying EBITDA

Jun-YE |

|

2017 |

2018 |

2019E |

2020E |

2021E |

Balance sheet |

|

|

|

|

|

|

Net operating assets |

|

15,261 |

19,650 |

19,986 |

20,817 |

21,751 |

Investments |

|

8 |

0 |

0 |

0 |

0 |

Equity |

|

8,092 |

7,387 |

7,495 |

8,105 |

9,054 |

Minority interest |

|

0 |

0 |

0 |

0 |

0 |

Net debt |

|

7,177 |

12,263 |

12,491 |

12,711 |

12,698 |

Balance sheet ratios |

|

|

|

|

|

|

Gearing (net debt/(net debt+equity)) |

|

47.0% |

62.4% |

62.5% |

61.1% |

58.4% |

Net debt to EBITDA |

|

6.7x |

9.7x |

4.0x |

3.2x |

2.6x |

RoCE |

|

3.9% |

4.4% |

11.4% |

15.2% |

17.8% |

RoIC (after tax) |

|

4.2% |

5.9% |

10.8% |

12.5% |

14.0% |

RoE |

|

-7.5% |

-9.0% |

1.5% |

7.8% |

11.1% |

Cash flow statement |

|

|

|

|

|

|

Operating cash flow |

|

934 |

225 |

3,585 |

3,482 |

3,728 |

Capex (net of disposals) |

|

-1,645 |

-3,778 |

-2,050 |

-1,762 |

-1,572 |

Other |

|

-433 |

-413 |

-331 |

-342 |

-356 |

FCF |

|

-1,143 |

-3,966 |

1,205 |

1,379 |

1,800 |

Equity shareholders' cash |

|

-1,127 |

-3,980 |

1,115 |

1,314 |

1,766 |

Dividends and share buy backs |

|

0 |

0 |

0 |

0 |

0 |

Non-cash increase in debt |

|

-1,017 |

-1,107 |

-1,343 |

-1,534 |

-1,753 |

Movement in net debt |

|

-2,144 |

-5,086 |

-228 |

-220 |

14 |

Cash flow ratios |

|

58 |

118 |

47 |

46 |

45 |

Working capital days |

|

|||||

FCF yield |

|

-4.8% |

-14.3% |

4.4% |

5.0% |

6.5% |

Equity shareholders' yield |

|

-6.7% |

-25.7% |

7.5% |

8.8% |

11.9% |

Capex/EBITDA |

|

154.0% |

297.9% |

65.4% |

43.8% |

32.8% |

Cash conversion |

|

1.8x |

5.7x |

10.3x |

2.2x |

1.9x |

Valuation |

|

|

|

|

|

|

SoTP DCF fair value and calculation of target price |

|

|

ZARmn |

ZAR/sh |

||

Zondereinde operations |

|

|

|

8,301 |

23.7 |

|

Booysendal operations |

|

|

|

18,020 |

51.5 |

|

Other |

|

|

|

-184 |

-0.5 |

|

Enterprise value |

|

|

|

26,137 |

74.7 |

|

Investments as at 30 June 2018 |

|

|

|

0 |

0.0 |

|

Net debt as at 30 June 2018 |

|

|

|

-12,263 |

-35.1 |

|

Cash used in share buy-backs during 2019E |

|

|

|

0 |

0.0 |

|

Minority interest |

|

|

|

0 |

0.0 |

|

Equity value |

|

|

|

13,874 |

39.7 |

|

Rounded to |

|

|

|

|

40 |

|

Current share price on 7/1/2019 |

|

|

|

|

42.6 |

|

Expected share price return |

|

|

|

|

-6.1% |

|

Plus: expected dividend yield |

|

|

|

|

0.0% |

|

Total implied one-year return |

|

|

|

|

-6.1% |

|

Share price range, ZAR:

|

|

|

12-month high |

60 |

12-month low |

|

32 |

||

|

|

|

Price move since high |

-29.2% Price move since low |

|

34.6% |

|||

|

|

|

Calculation of WACC |

|

|

|

|

|

|

|

|

Zondereinde |

WACC |

14.5% |

Cost of debt |

|

|

12.5% |

|

|

|

Risk-free rate |

9.0% |

Tax rate |

|

|

28% |

||

|

|

45% |

|

|

|||||

|

|

Equity risk premium |

6.0% |

After-tax cost of debt |

|

9.0% |

|||

|

|

|

|

||||||

Booysendal |

|

Beta |

1.3 |

Debt weighting |

|

30% |

|||

|

Cost of equity |

16.8% |

Terminal growth rate |

|

6.0% |

||||

55% |

|

|

|||||||

|

|

|

Valuation ratios |

|

|

|

|

|

|

|

|

|

Jun-YE |

2017 |

2018 |

|

2019E |

2020E |

2021E |

|

|

|

P/E multiple |

-26.4x |

-22.1x |

|

138.1x |

24.4x |

15.7x |

|

|

|

Normalised P/E multiple |

61.5x |

53.5x |

|

14.8x |

10.0x |

8.0x |

|

|

|

Dividend yield |

0.0% |

0.0% |

|

0.0% |

0.0% |

0.0% |

|

|

|

EV/EBITDA |

22.4x |

21.9x |

|

8.7x |

6.9x |

5.8x |

|

|

|

P/B |

2.1x |

2.1x |

|

2.0x |

1.8x |

1.6x |

|

|

|

NAV per share, ZAR |

23 |

21 |

|

21 |

23 |

26 |

Source: Bloomberg, Thomson Reuters, Renaissance Capital estimates

76