- •Preface

- •Contents

- •Chapter 1

- •1.1 International Financial Markets

- •Foreign Exchange

- •Covered Interest Parity

- •Uncovered Interest Parity

- •Futures Contracts

- •1.2 National Accounting Relations

- •National Income Accounting

- •The Balance of Payments

- •1.3 The Central Bank’s Balance Sheet

- •Chapter 2

- •2.1 Unrestricted Vector Autoregressions

- •Lag-Length Determination

- •Granger Causality, Econometric Exogeniety and Causal

- •Priority

- •The Vector Moving-Average Representation

- •Impulse Response Analysis

- •Forecast-Error Variance Decomposition

- •Potential Pitfalls of Unrestricted VARs

- •2.2 Generalized Method of Moments

- •2.3 Simulated Method of Moments

- •2.4 Unit Roots

- •The Levin—Lin Test

- •The Im, Pesaran and Shin Test

- •The Maddala and Wu Test

- •Potential Pitfalls of Panel Unit-Root Tests

- •2.6 Cointegration

- •The Vector Error-Correction Representation

- •2.7 Filtering

- •The Spectral Representation of a Time Series

- •Linear Filters

- •The Hodrick—Prescott Filter

- •Chapter 3

- •The Monetary Model

- •Cassel’s Approach

- •The Commodity-Arbitrage Approach

- •3.5 Testing Monetary Model Predictions

- •MacDonald and Taylor’s Test

- •Problems

- •Chapter 4

- •The Lucas Model

- •4.1 The Barter Economy

- •4.2 The One-Money Monetary Economy

- •4.4 Introduction to the Calibration Method

- •4.5 Calibrating the Lucas Model

- •Appendix—Markov Chains

- •Problems

- •Chapter 5

- •Measurement

- •5.2 Calibrating a Two-Country Model

- •Measurement

- •The Two-Country Model

- •Simulating the Two-Country Model

- •Chapter 6

- •6.1 Deviations From UIP

- •Hansen and Hodrick’s Tests of UIP

- •Fama Decomposition Regressions

- •Estimating pt

- •6.2 Rational Risk Premia

- •6.3 Testing Euler Equations

- •Volatility Bounds

- •6.4 Apparent Violations of Rationality

- •6.5 The ‘Peso Problem’

- •Lewis’s ‘Peso-Problem’ with Bayesian Learning

- •6.6 Noise-Traders

- •Problems

- •Chapter 7

- •The Real Exchange Rate

- •7.1 Some Preliminary Issues

- •7.2 Deviations from the Law-Of-One Price

- •The Balassa—Samuelson Model

- •Size Distortion in Unit-Root Tests

- •Problems

- •Chapter 8

- •The Mundell-Fleming Model

- •Steady-State Equilibrium

- •Exchange rate dynamics

- •8.3 A Stochastic Mundell—Fleming Model

- •8.4 VAR analysis of Mundell—Fleming

- •The Eichenbaum and Evans VAR

- •Clarida-Gali Structural VAR

- •Appendix: Solving the Dornbusch Model

- •Problems

- •Chapter 9

- •9.1 The Redux Model

- •9.2 Pricing to Market

- •Full Pricing-To-Market

- •Problems

- •Chapter 10

- •Target-Zone Models

- •10.1 Fundamentals of Stochastic Calculus

- •Ito’s Lemma

- •10.3 InÞnitesimal Marginal Intervention

- •Estimating and Testing the Krugman Model

- •10.4 Discrete Intervention

- •10.5 Eventual Collapse

- •Chapter 11

- •Balance of Payments Crises

- •Flood—Garber Deterministic Crises

- •11.2 A Second Generation Model

- •Obstfeld’s Multiple Devaluation Threshold Model

- •Bibliography

- •Author Index

- •Subject Index

8.4. VAR ANALYSIS OF MUNDELL—FLEMING |

257 |

Appendix: Solving the Dornbusch Model

From (8.9) and (8.11), we see that the behavior of i(t) is completely determined by that of s(t). This means that we need only determine the di erential equations governing the exchange rate and the price level to obtain a complete characterization of the system’s dynamics.

Substitute (8.9) and (8.11) into (8.6). Make use of (8.13) and rearrange

to obtain |

|

1 |

|

|

|

|

|

|

|

|

[p(t) − p¯]. |

(8.58) |

|||||

|

sú(t) = |

|

||||||

|

λ |

|||||||

To obtain the di erential equation for the price level, begin by substituting |

||||||||

(8.58) into (8.9), and then substituting the result into (8.8) to get |

(144) |

|||||||

pú(t) = π[δ(s(t) − p(t)) + (γ − 1)y − σi − |

σ |

|

||||||

|

(p(t) − p¯) + g]. |

(8.59) |

||||||

λ |

||||||||

However, in the long run |

|

|

|

|

|

|

|

|

|

0 = π[δ(¯s − p¯) + (γ − 1)y − σr + g], |

(8.60) |

||||||

the price dynamics are more conveniently characterized by |

(145) |

|||||||

|

pú(t) = π ·δ(s(t) − s¯) − (δ + λ )(p(t) − p¯)¸ , |

(8.61) |

||||||

|

|

|

|

|

σ |

|

||

which is obtained by subtracting (8.60) from (8.59). |

|

|||||||

Now write (8.58) and (8.61) as the system |

|

|||||||

|

à pú(t) |

! = A Ã p(t) − p¯ ! , |

(8.62) |

|||||

|

sú(t) |

|

|

s(t) s¯ |

|

|||

|

|

|

|

|

− |

|

||

where |

à |

! |

|

|||||

|

|

|||||||

01/λ

A = |

πδ |

−π(δ + σ/λ) |

. |

|

|

(8.62) is a system of two linear homogeneous di erential equations. We know that the solutions to these systems take the form

s(t) |

= |

s¯ + αeθt, |

(8.63) |

p(t) |

= |

p¯ + βeθt. |

(8.64) |

We will next substitute (8.63) and (8.64) into (8.62) and solve for the unknown coe cients, α, β, and θ. First, taking time derivatives of (8.63)

and (8.64) yields |

|

|

|

sú |

= |

θαeθt, |

(8.65) |

pú |

= |

θβeθt. |

(8.66) |

|

258 |

CHAPTER 8. THE MUNDELL-FLEMING MODEL |

|||||||||

|

Substitution of (8.65) and (8.66) into (8.62) yields |

|

|||||||||

|

|

|

|

|

|

(A − θI2) Ã β |

! = 0. |

|

(8.67) |

||

|

|

|

|

|

|

|

|

α |

|

|

|

|

In order for (8.67) to have a solution other than the trivial one (α, β) = (0, 0), |

||||||||||

|

requires that |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

0 = |

|A − θI2| |

|

|

(8.68) |

|||

|

|

|

|

= |

θ2 − T r(A)θ + |A|, |

(8.69) |

|||||

(146) |

where Tr(A) = −π(δ + σ/λ) and |A| = −πδ/λ otherwise, (A −θI2)−1 exists |

||||||||||

|

which means that the unique solution is the trivial one, which isn’t very |

||||||||||

|

interesting. Imposing the restriction that (8.69) is true, we Þnd that its |

||||||||||

|

roots are |

θ1 |

= |

|

2[T r(A) − qT r2(A) − 4|A|] < 0, |

(8.70) |

|||||

|

|

|

|||||||||

|

|

|

|

|

1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

θ2 |

= |

|

2[T r(A) + qT r2(A) − 4|A|] > 0. |

(8.71) |

|||||

|

The general solution is |

1 |

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

s(t) = |

s¯ + α1eθ1t + α2eθ2t, |

(8.72) |

|||||

|

|

|

|

p(t) = |

p¯ + β1eθ1t + β2eθ2t. |

(8.73) |

|||||

This solution is explosive, however, because of the eventual dominance of the positive root. We can view an explosive solution as a bubble, in which the exchange rate and the price level diverges from values of the economic fundamentals. While there are no restrictions within the model to rule out explosive solutions, we will simply assume that the economy follows the stable solution by setting α2 = β2 = 0, and study the solution with the stable root

θ ≡ −θ1 |

|

|

|

|

|

|

|

|

(8.74) |

|

= 2[π(δ + σ/λ) + qπ2(δ + σ/λ)2 + 4πδ/λ]. |

(8.75) |

|||||||||

1 |

|

|

|

|

|

|

|

|

|

|

Now, to Þnd the stable solution, we solve (8.67) with the stable root |

|

|||||||||

0 = (A − θ1I2) |

à β |

! |

|

|

|

|||||

à |

|

|

|

α |

β ! |

|

||||

πδ |

|

θ1 |

|

π(δ + σ/λ) ! Ã |

|

|||||

= |

|

−θ1 |

− |

|

− |

1/λ |

α . |

|

||

|

|

|

|

|

|

|

|

(8.76) |

||

|

|

|

|

|

|

|

|

|

|

|

8.4. VAR ANALYSIS OF MUNDELL—FLEMING |

259 |

|||||

When this is multiplied out, you get |

|

|

|

|

||

0 |

= |

−θ1α + β/λ, |

µδ + λ |

¶]β. |

(8.77) |

|

0 |

= |

πδα − [θ1 + π |

(8.78) |

|||

|

|

|

|

σ |

|

|

It follows that |

|

|

|

|

|

|

|

|

α = β/θ1λ. |

|

(8.79) |

||

Because α is proportional to β, we need to impose a normalization. Let this normalization be β = po − p¯ where po ≡ p(0). Then α = (po − p¯)/θ1λ = −[po − p¯]/θλ, where θ ≡ −θ1. Using these values of α and β in (8.63) and (8.64), yields

p(t) |

= |

p¯ + [po − p¯]e−θt, |

(8.80) |

s(t) |

= |

s¯ + [so − s¯]e−θt, |

(8.81) |

where (so − s¯) = −[po − p¯]/θλ. This solution gives the time paths for the price level and the exchange rate.

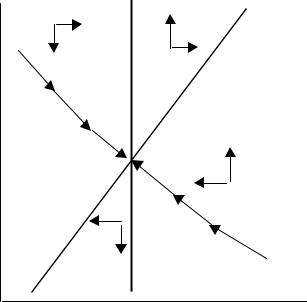

To characterize the system and its response to monetary shocks, we will want to phase diagram the system. Going back to (8.58) and (8.61), we see that sú(t) = 0 if and only if p(t) = p¯, while pú(t) = 0 if and only if s(t) −s¯ = (1+ σ/λδ)(p(t) −p¯). These points are plotted in Figure 8.10. The system displays a saddle path solution.

260 |

CHAPTER 8. THE MUNDELL-FLEMING MODEL |

s |

. |

|

p=0

.

s=0

p

Figure 8.10: Phase diagram for the Dornbusch model.