- •Preface

- •Contents

- •Chapter 1

- •1.1 International Financial Markets

- •Foreign Exchange

- •Covered Interest Parity

- •Uncovered Interest Parity

- •Futures Contracts

- •1.2 National Accounting Relations

- •National Income Accounting

- •The Balance of Payments

- •1.3 The Central Bank’s Balance Sheet

- •Chapter 2

- •2.1 Unrestricted Vector Autoregressions

- •Lag-Length Determination

- •Granger Causality, Econometric Exogeniety and Causal

- •Priority

- •The Vector Moving-Average Representation

- •Impulse Response Analysis

- •Forecast-Error Variance Decomposition

- •Potential Pitfalls of Unrestricted VARs

- •2.2 Generalized Method of Moments

- •2.3 Simulated Method of Moments

- •2.4 Unit Roots

- •The Levin—Lin Test

- •The Im, Pesaran and Shin Test

- •The Maddala and Wu Test

- •Potential Pitfalls of Panel Unit-Root Tests

- •2.6 Cointegration

- •The Vector Error-Correction Representation

- •2.7 Filtering

- •The Spectral Representation of a Time Series

- •Linear Filters

- •The Hodrick—Prescott Filter

- •Chapter 3

- •The Monetary Model

- •Cassel’s Approach

- •The Commodity-Arbitrage Approach

- •3.5 Testing Monetary Model Predictions

- •MacDonald and Taylor’s Test

- •Problems

- •Chapter 4

- •The Lucas Model

- •4.1 The Barter Economy

- •4.2 The One-Money Monetary Economy

- •4.4 Introduction to the Calibration Method

- •4.5 Calibrating the Lucas Model

- •Appendix—Markov Chains

- •Problems

- •Chapter 5

- •Measurement

- •5.2 Calibrating a Two-Country Model

- •Measurement

- •The Two-Country Model

- •Simulating the Two-Country Model

- •Chapter 6

- •6.1 Deviations From UIP

- •Hansen and Hodrick’s Tests of UIP

- •Fama Decomposition Regressions

- •Estimating pt

- •6.2 Rational Risk Premia

- •6.3 Testing Euler Equations

- •Volatility Bounds

- •6.4 Apparent Violations of Rationality

- •6.5 The ‘Peso Problem’

- •Lewis’s ‘Peso-Problem’ with Bayesian Learning

- •6.6 Noise-Traders

- •Problems

- •Chapter 7

- •The Real Exchange Rate

- •7.1 Some Preliminary Issues

- •7.2 Deviations from the Law-Of-One Price

- •The Balassa—Samuelson Model

- •Size Distortion in Unit-Root Tests

- •Problems

- •Chapter 8

- •The Mundell-Fleming Model

- •Steady-State Equilibrium

- •Exchange rate dynamics

- •8.3 A Stochastic Mundell—Fleming Model

- •8.4 VAR analysis of Mundell—Fleming

- •The Eichenbaum and Evans VAR

- •Clarida-Gali Structural VAR

- •Appendix: Solving the Dornbusch Model

- •Problems

- •Chapter 9

- •9.1 The Redux Model

- •9.2 Pricing to Market

- •Full Pricing-To-Market

- •Problems

- •Chapter 10

- •Target-Zone Models

- •10.1 Fundamentals of Stochastic Calculus

- •Ito’s Lemma

- •10.3 InÞnitesimal Marginal Intervention

- •Estimating and Testing the Krugman Model

- •10.4 Discrete Intervention

- •10.5 Eventual Collapse

- •Chapter 11

- •Balance of Payments Crises

- •Flood—Garber Deterministic Crises

- •11.2 A Second Generation Model

- •Obstfeld’s Multiple Devaluation Threshold Model

- •Bibliography

- •Author Index

- •Subject Index

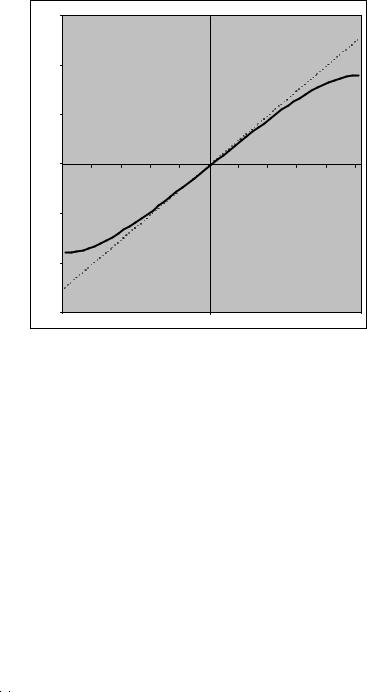

10.3. INFINITESIMAL MARGINAL INTERVENTION |

317 |

0.03 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

s |

|

|

|

|

0.02 |

|

|

|

|

|

|

|

|

|

|

0.01 |

|

|

|

|

|

|

|

|

|

|

0 |

|

|

|

|

|

|

|

|

|

f |

-0.03 |

-0.02 |

-0.02 |

-0.01 |

0.00 |

0.00 |

0.01 |

0.01 |

0.02 |

0.02 |

0.03 |

-0.01 |

G(f) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

-0.02 |

|

|

|

|

|

|

|

|

|

|

|

s=f |

|

|

|

|

|

|

|

|

|

-0.03 |

|

|

|

|

|

|

|

|

|

|

Figure 10.1: Relation between exchange rate and fundamentals under pure ßoat and Krugman interventions

Estimating and Testing the Krugman Model

DeJong [36] estimates the Krugman model by maximum likelihood and by simulated method of moments (SMM) using weekly data from January 1987 to September 1990. He ends his sample in 1990 so that exchange rates a ected by news or expectations about German reuniÞcation, which culminated in the European Monetary System crisis of September 1992, are not included.

We will follow De Jong’s SMM estimation strategy to estimate the basic Krugman model

∆ft |

= |

η + σut, |

Gt |

= αη + ft + Aeλ1ft + Beλ2ft , |

|

¯ iid

where f = −f, the time unit is one day (∆t = 1), and ut N(0, 1). λ1

and λ2 are given in (10.34)-(10.35), and A and B are given in (10.38)

318 CHAPTER 10. TARGET-ZONE MODELS

and (10.39). The observations are daily DM prices of the Belgian franc, French franc, and Dutch guilder from 2/01/87 to 10/31/90. Log exchange rates are normalized by their central parities and multiplied by 100. The parameters to be estimated are (η, α, σ, f¯). SMM is covered in Chapter 2.3.

Denote the simulated observations with a ‘tilde.’ You need to simulated sequences of the fundamentals that are guaranteed to stay within the bands [f, f¯]. You can do this by letting fˆj+1 = f˜j + η + σuj and

setting |

fˆ |

|

if fj+1 |

≥ˆ f |

|

¯ |

|

|

|

||||||||

˜ |

|

|

|

|

|

||||||||||||

|

|

¯ |

|

|

|

ˆ |

|

|

|

¯ |

|

|

|

|

|

||

|

|

|

|

|

|

|

≤ |

|

|

≤ |

|

|

|

|

|||

fj+1 |

|

|

|

if |

ˆ |

|

|

fj+1 |

|

f |

|

|

(10.41) |

||||

= fj+1 |

|

f |

|

|

|

|

|

|

|

||||||||

|

f |

|

if |

fj+1 ≤ f |

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

for j = 1, . . . , M. The simulated exchange rates are given by |

|

||||||||||||||||

s˜j(η, α, σ, f¯) = f˜j + αη + Aeλ1f˜j |

+ Beλ2f˜j , |

(10.42) |

|||||||||||||||

the simulated moments by |

|

|

|

|

|

M Pj=3 ∆s˜j |

|

|

|

||||||||

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

1 |

|

|

|

M |

∆s˜j |

|

|

|

||

HM [˜s(η, α, σ, f¯)] = |

|

|

|

|

M |

|

|

j=3 |

|

. |

|

||||||

|

|

|

|

M |

Pj=3 |

∆s˜j |

|

|

|||||||||

|

|

|

|

|

|

|

1 |

|

|

|

M |

|

2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

1 |

|

|

|

M |

|

∆s˜j∆s˜j 1 |

|

|

|||||

|

|

|

M |

|

|

|

jP |

|

|

||||||||

|

|

|

|

|

|

1 |

M |

|

− |

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

3 |

|

|

|

|||

|

|

|

1 |

|

|

|

M |

|

|

|

|

|

|

||||

|

|

|

|

|

M |

Pj=3 ∆s˜j∆s˜j 2 |

|

|

|

||||||||

|

|

|

|

|

|

P |

|

=3 |

|

|

− |

|

|

|

|||

The sample moments are based on the Þrst three moments and the Þrst two autocovariances

|

|

|

|

T |

P |

T |

|

|

|

|

|

1 |

|

∆st |

|

||

Ht(s) = |

|

|

|

T |

|

t=3 |

|

|

|

|

|

T |

Pt=3 ∆st |

|

|||

|

|

|

|

1 |

|

tT=3 ∆st2 |

|

|

|

|

|

|

|

|

|

|

|

|

1 |

|

|

T |

∆st∆st 1 |

|||

|

T |

|

|

tP |

||||

|

|

|

|

T |

− |

|

||

|

|

|

1 |

T |

|

|||

|

|

5 |

P |

=3 |

|

− |

|

|

|

|

1 |

Pt=3 |

∆s ∆s |

|

|||

|

|

T |

|

t t 2 |

|

|||

with M = 20T, where T = 978.

The results are given in Table 10.1. As you can see, the estimates are reasonable in magnitude and have the predicted signs, but they are not very precise. The χ2 test of the (one) overidentifying restriction is rejected at very small signiÞcance levels indicating that the data are inconsistent with the model.

5No adjustments were made for weekends or holidays.